Euro zone headline inflation slowed in June, data published by the European Commission today confirmed, easing pressure on the European Central Bank (ECB) to start tightening at its policy meeting scheduled on Thursday this week. Analysts at Lloyds Bank expect the ECB will leave its policy rates unchanged and make no new announcements on its asset purchase programme.

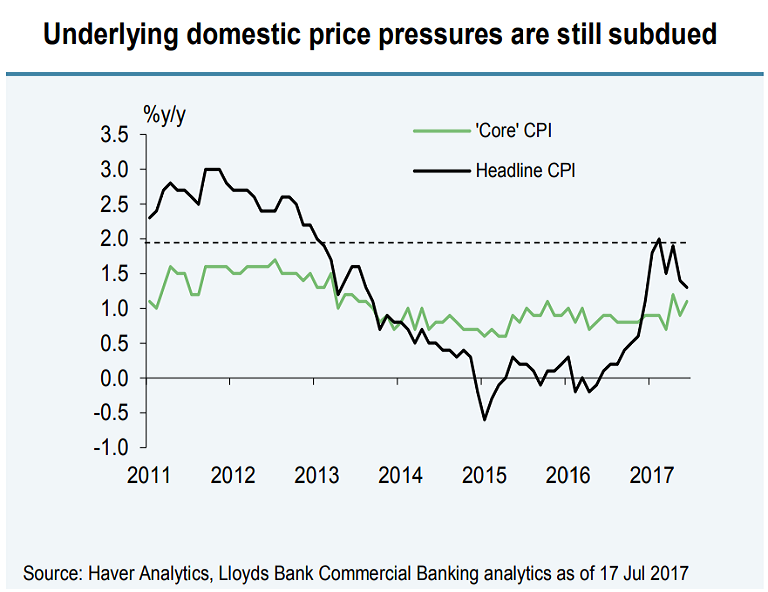

Data released on Monday showed Euro zone consumer prices rose 1.3 percent year-on-year in June, in line with market expectations, decelerating form 1.4 percent in May and 1.9 percent in April. But its core CPI which excludes unprocessed food and energy and closely watched by the ECB, rose to 1.2 percent on the year from 1.0 percent in May, above expectations for a 1.1 percent rise. On a monthly basis, headline inflation was zero in June, while core inflation was 0.2 percent, Eurostat said.

At its June meeting, the ECB revised up its assessment of economic growth to “broadly balanced” and removed its easing bias for interest rates. The economy expanded for the sixteenth consecutive quarter in Q1 2017, while indicators suggest that Q2 growth could be at least as strong as the robust 0.6 percent q/q pace seen in Q1.

Speculation has risen since the last meeting that the central bank might be readying markets for tighter policy at its July meeting. However, the failure of Eurozone inflationary pressure to pick up towards the ECB’s two percent target, despite the continued fall in unemployment will make the central bank wary of raising tightening conditions. Inflation surged to the two percent target in February, however, has since moderated to 1.5 percent in Germany in June, and only 0.8 percent in France.

“Striking a balance between the weak inflation outlook, above-potential growth and the credibility of instruments remains a major communication challenge for the ECB, with ample room for ambiguity affecting markets,” said Anatoli Annenkov, an economist at Societe Generale.

EUR/USD was trading at 1.1465 at around 1115 GMT. The pair has been on a gradual uptrend since the beginning of the year. The pair is extending gains from lows of 1.0340 last seen since Dec 2002. We see continuation of upside, next bull target lies at 1.1616 (May 2016 high). We see immediate support at 1.1410 (1H 200-SMA) and resistance at 1.1489 (July 12 high).

FxWirePro's Hourly EUR Spot Index was neutral at -65.7618. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Korea Factory Activity Hits 18-Month High as Export Demand Surges

South Korea Factory Activity Hits 18-Month High as Export Demand Surges  Philippines Manufacturing PMI Hits Nine-Month High Despite Weak Confidence Outlook

Philippines Manufacturing PMI Hits Nine-Month High Despite Weak Confidence Outlook  Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions

Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  S&P 500 Rises as AI Stocks and Small Caps Rally on Strong Earnings Outlook

S&P 500 Rises as AI Stocks and Small Caps Rally on Strong Earnings Outlook  Dollar Holds Firm as Strong U.S. Data, Fed Expectations and Global Central Bank Moves Shape Markets

Dollar Holds Firm as Strong U.S. Data, Fed Expectations and Global Central Bank Moves Shape Markets  Starmer’s China Visit Highlights Western Balancing Act Amid U.S.-China Rivalry

Starmer’s China Visit Highlights Western Balancing Act Amid U.S.-China Rivalry  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold, Silver, and Platinum Rally as Precious Metals Recover from Sharp Selloff

Gold, Silver, and Platinum Rally as Precious Metals Recover from Sharp Selloff  Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China

Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China  UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist

UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist