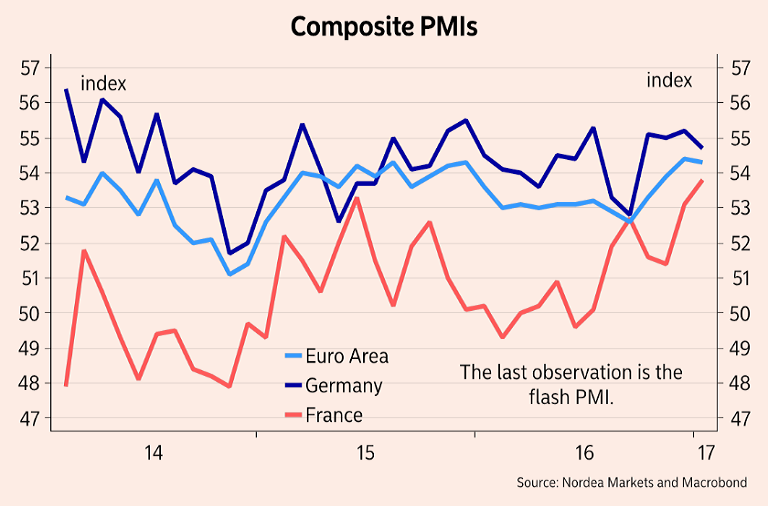

Eurozone Composite PMI for January fell slightly from the previous month but remained comfortably above the 50 mark signalling stronger GDP growth for the single currency area. IHS Markit's Euro Zone Flash Composite Purchasing Managers' Index showed euro-area Composite Purchasing Managers' Index fell slightly from December's five-year high of 54.4 to 54.3.

First look at the Eurozone Composite PMI for January suggests euro area economic growth remained resilient at the start of 2017 and the positive momentum seems likely to continue. Details of the report showed manufacturing PMI rose slightly to 55.1 and was at the highest level since 2011, while service index stood at 53.6, nearly unchanged from December.

Sub-index measuring prices charged spent its third month above the break-even mark although it ticked down to 51.6 from December's 51.7, which was the highest since July 2011. Eurozone employment growth stood at nine-year high as businesses report strong start to 2017. Hiring gained momentum in both services and manufacturing on the back of sustained growth of new orders.

Inflationary pressures meanwhile intensified further in January. Firms’ average input costs rose at the fastest rate since May 2011, with rates of increase accelerating in both services and manufacturing. Improved pricing power, combined with the desire to push higher costs on to customers, led to a further increase in average selling prices for goods and services in January.

Consumer prices rose in December in almost all of the eurozone’s 19 members, a sign the threat of deflation has abated. Core inflation—which excludes energy and food prices—edged up to 0.9 percent from 0.8 percent, but was still weaker than policy makers would like. Signs of ongoing inflationary pressures from PMI survey will be welcomed by policymakers.

"The recent strengthening of demand is at least starting to help restore some pricing power among suppliers, hinting at an upturn in core inflationary pressures,” said Chris Williamson, Chief Business Economist at IHS Markit.

EUR/USD was 0.29 percent lower on the day at 1.0732 at 1140 GMT. Technical studies support further upside in the pair. We see scope for test of 100-DMA at 1.0826. 5-DMA at 1.0698 is immediate support on the downside. Break below could see test of 20-DMA at 1.0582. FxWirePro's Hourly EUR spot Index was at 29.2352 (Neutral) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility