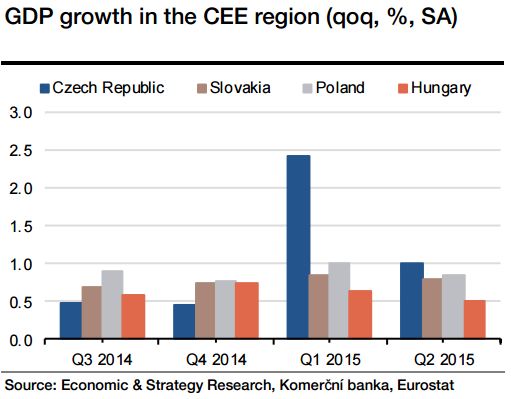

The structure of GDP growth in the Centeral and Eastern Europe (CEE) region is gradually changing. While in 2011 and 2012, net exports represented the key source of GDP growth, we are now seeing a visible shift towards domestic demand. This is important as it reduces the region's reliance on the external environment as well as its exposure to macro-economic risks (slowdown in China, Grexit scenario and geopolitical risks).

Domestic demand has now become the key driver of GDP growth, particularly in Poland, Czech Republic and Slovakia, while net exports are tending to reduce growth or support it just marginally (in Q2 15 net exports contributed 0.1pp yoy to GDP growth in Poland and 0.3pp yoy in the Czech Republic). A different situation can be seen in Hungary, where net exports continue to play an important role in the country's economic performance (in Q2 15 net exports contributed 1.5pp yoy to growth). For the CEE region as a whole, we expect this trend to continue as rising domestic demand is likely to put upward pressure on imports of investment and consumer goods, while exports could suffer from the still weak euro-area revival.

Household consumption and fixed investment are thus gradually taking over as the key GDP growth drivers in the CEE region, while government consumption is pushing growth higher as well. Household consumption is being supported by rising employment across the region, rising wages and increasing household spending appetites. Fixed investment is also showing strong growth as CEE governments try to tap as much money as possible from the EU funds as the chance to obtain funds for the programming period 2007-2013 ends this year. Gross fixed capital formation increased by more than 6% yoy on average within the CEE countries, with Slovakia at the top (9.4 % yoy). From the supply-side point of view, manufacturing and the wholesale and retail trade remain the key drivers of GDP growth in the region. Nevertheless, growth is fairly evenly spread across most sectors (although significant drops have been observed in the Hungarian agricultural sector and the Slovak financial sector).

Next year, the new 2014-2020 programming period for tapping EU funds will start. This usually leads national governments to make less of an effort to pump money. As a result, fixed investment is likely to decelerate next year and the region's GDP growth will subside. For the Czech Republic, we expect GDP to grow by 4.5% this year, but to slow down to 2.7% next year due to the drop in EU-fund related investment. Meanwhile, the Polish and Slovak economies should remain above 3% while Hungarian GDP is likely to decelerate from 3.3% this year to 2.5% in 2016, according to the Hungarian central bank.

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Gold Prices Pull Back After Record Highs as January Rally Remains Strong

Gold Prices Pull Back After Record Highs as January Rally Remains Strong  Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals

Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals  Japan Election Poll Signals Landslide Win for Sanae Takaichi, Raising Fiscal Policy Concerns

Japan Election Poll Signals Landslide Win for Sanae Takaichi, Raising Fiscal Policy Concerns  Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors

Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors  Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.

Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.  China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy

China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy  Dollar Holds Firm as Markets Weigh Warsh-Led Fed and Yen Weakness Ahead of Japan Election

Dollar Holds Firm as Markets Weigh Warsh-Led Fed and Yen Weakness Ahead of Japan Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed