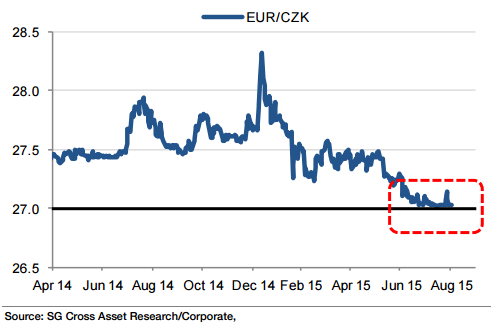

The CZK was the top performing currency in August, rising 2.2% vs the USD and 0.13% vs the EUR. The current account surplus (0.6% of GDP in 2014) offers stability during periods of market stress.

Q2 GDP rose to 4.4% yoy from 4.0%, the highest since Q1 08 and the strongest result in Europe. This further supports CZK appreciation pressure. A 30% chance of the CNB resorting to a negative deposit rate, said Societe Generale in a research note on Friday.

EUR-CZK to move lower has recently been strengthened by the year-to-date improvement in most economic indicators and the pickup in inflation in the Czech Republic. Q1 GDP growth surged to 4% yoy (vs. 1.3% yoy in Q4'14), while headline inflation climbed from 0.1% in Jan'15 to 0.8% in Jun' will abide by its commitment to an exit from the current regime in H2'16, while continuing to deploy discretionary FX interventions thereafter, adds Societe Generale.

Are negative interest rates next in CZK?

Friday, September 4, 2015 12:26 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022