Denmark is set to extend economic recovery for the fifth consecutive year. Recovery in the Nordic nation has been relatively moderate till now. But there is more distinct possibility of a more robust recovery on robust economic growth and rising employment.

Exports were a disappointment in 2016, but stronger global GDP growth should pave the way for a recovery in exports. The global economy is on the cusp of a synchronous recovery and if sentiment truly turns positive, Denmark could be witnessing significantly stronger increases both in consumer spending and investment.

"We expect the Danish economic recovery to remain on track, supported by a growing labour force and stronger global and domestic demand. There is a risk of the economy overheating within the next few years, although it could also take the opposite course," said Danske Bank in a report.

Inflation in Denmark is making a comeback. Indeed, inflation in 2016 was at its lowest level since 1953. As rent increases in large parts of the residential rental market are linked to the previous year’s inflation numbers, we can expect a certain inertia in Danish inflation. However, last year’s low inflation level is likely to keep a lid on inflation in 2017.

Prices of Danish imports have fallen relative to the price of exports. This improvement in the terms of trade has the same effect as higher productivity. Statistics Denmark has carried out a comprehensive revision of the national accounts, which are now showing far more positive GDP and productivity figures for Denmark.

"We expect it to hit the 1 percent mark at the beginning of 2017 for the first time in three years. We expect inflation to rise to 1.3 percent in 2017, and while this is much higher than the levels of the past few years, inflation remains subdued." said Danske Bank in a report.

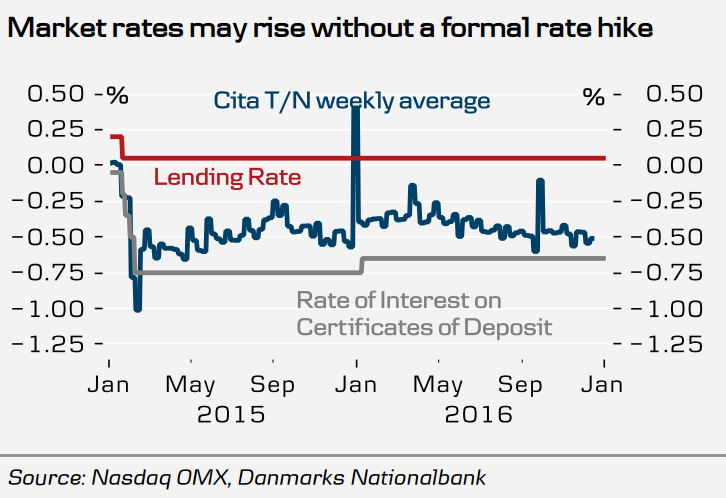

No monetary policy changes on the cards from Danmarks Nationalbank in 2017. Danish central bank could respond in the form of currency intervention instead of rate cuts to curb upward pressure on the krone, but such intervention may also push down market rates somewhat. Fiscal policy is likely to be tightened in 2018.

"While we do not expect de facto rate hikes from the ECB until 2019 at the earliest, DN may hike rates before that given that its lowest official interest rate is lower than the ECB’s lowest rate. Danish long yields have climbed on the back of higher yields in the US and this trend may well continue." adds Danske Bank.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal