In its latest move to spur business investment, the government will extend its $150,000 instant assets write-off until the end of the year.

The six-months extension, which will be legislated, will cost $300 million in revenue over the forward estimates.

As part of the government’s pandemic emergency measures, in March it announced that until June 30 the write-off threshold would be $150,000 and the size of businesses eligible would be those with turnovers of under $500 million.

The government is battling a major investment slump. Bureau of Statistics capital expenditure figures show non-mining investment fell 23% in the March quarter and 9% over the year to March.

Spending on plant and equipment fell 21%, spending on buildings and equipment plunged 25%.

An extra six months

Apart from giving businesses generally more time to claim the write-off, the government says the extension will help those which have been hit by supply chain delays caused by the pandemic.

The write-off helps businesses’ cash flow by bringing forward tax deductions. The $150,000 applies to individual assets – new or secondhand - therefore a single enterprise can write off a number of assets under the concession.

With rain breaking the drought in many areas, farm businesses are getting back into production, so the government will hope the extension will encourage spending on agricultural equipment.

About 3.5 million businesses are eligible under the scheme.

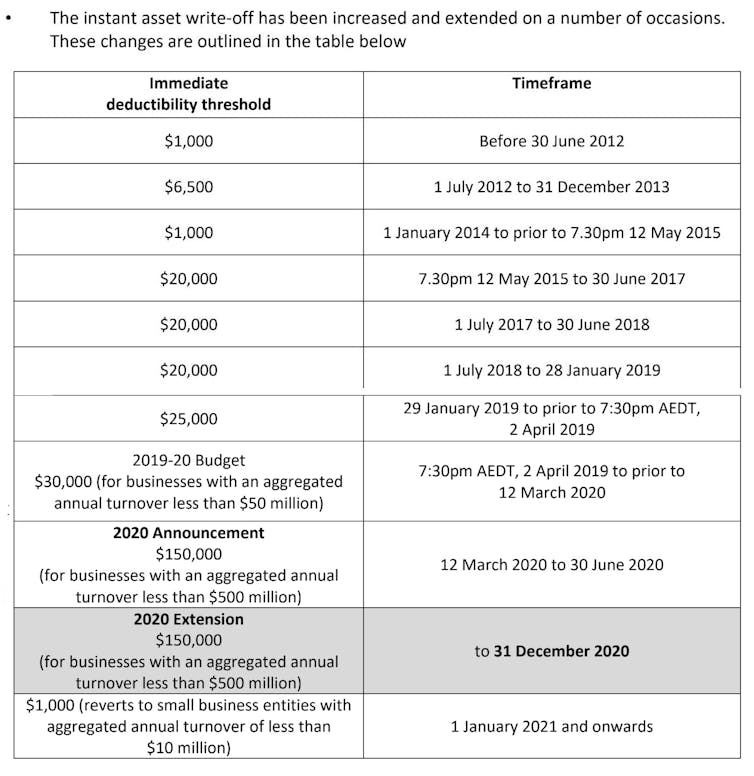

The instant asset write-off has been extended a number of times over the years, and its (much more modest) thresholds altered.

On the government’s revised timetable, from January 1 the write-off is due to be scaled down dramatically, reducing to a threshold of $1000 and with eligibility being confined to small businesses – those with an annual turnover of below $10 million.

But there will be pressure to continue with more generous arrangements, to head off the danger of a fresh collapse in investment.

In a statement, treasurer Josh Frydenberg and small business minister Michaelia Cash said the government’s actions “are designed to support business sticking with investment they had planned, and encourage them to bring investment forward to support economic growth over the near term”.

Commonwealth Government

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns