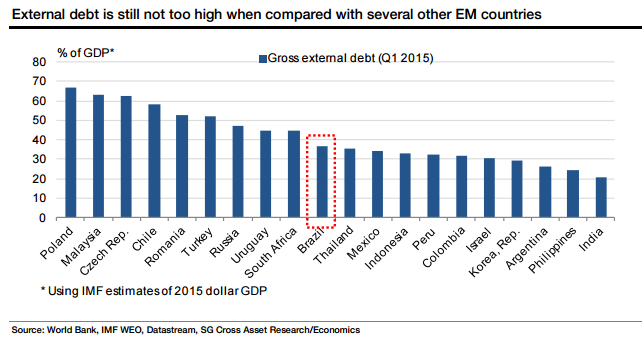

Brazil's external debt (ED) to GDP ratio - which declined to nearly 17% of GDP in 2008 and still stood at a moderate 25.2% at the end of 2013 - rose to 41% of GDP in Q3 15. While the increase in 2014 was driven by a rise in external borrowing, the recent increase in the ratio has been driven purely by the depreciation in the BRL that led to a contraction in dollar GDP. With the USD to BRL exchange rate expected to stay close to USD1= in Q4 15, the ED to GDP ratio is expected to rise to 45% of GDP this year.

Despite this significant increase, Brazil's ED to GDP ratio remains fairly comparable to that of most EM countries, including some Latam countries (Chile in particular). Furthermore, when looked at in isolation, it seems that the ED to GDP ratio itself is not all that threatening. Rather, it is Brazil's macro and financial situation that is responsible for the discomfort with the current level of ED to GDP ratio.

Brazil’s external debt is not among the worst in the EM world

Wednesday, September 30, 2015 8:53 PM UTC

Editor's Picks

- Market Data

Most Popular

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions  China Home Prices Rise in January as Government Signals Stronger Support for Property Market

China Home Prices Rise in January as Government Signals Stronger Support for Property Market  India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures

India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures  Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns

Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support

Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support  U.S. and El Salvador Sign Landmark Critical Minerals Agreement to Boost Investment and Trade

U.S. and El Salvador Sign Landmark Critical Minerals Agreement to Boost Investment and Trade