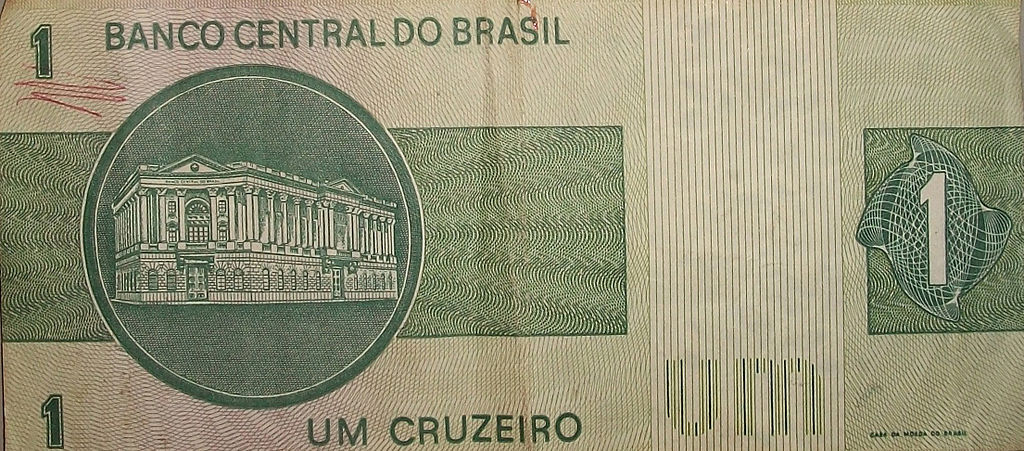

Brazil's central bank announced plans to conduct a $3 billion dollar auction with a repurchase agreement on Tuesday, aiming to roll over debt maturing on March 6. The auction will take place between 10:30 a.m. and 10:35 a.m. local time, with the repurchase set for October 2. This marks the third such auction by the central bank in 2025, reflecting ongoing efforts to manage Brazil's external debt obligations and stabilize the currency amid global economic uncertainties.

The auction underscores Brazil's strategy to maintain liquidity and ensure market confidence as the country navigates economic challenges. Dollar auctions with repurchase agreements are crucial tools for central banks, providing short-term funding while mitigating foreign exchange volatility. By rolling over debt, the central bank aims to ease market concerns over impending obligations and maintain financial stability.

The decision comes as emerging markets, including Brazil, face pressures from fluctuating global interest rates and currency depreciation risks. Analysts view this move as part of a broader strategy to defend the Brazilian real and manage the nation's foreign reserves effectively.

Market participants will closely monitor the auction results, which could impact Brazil's currency market and investor sentiment. The central bank's proactive approach highlights its commitment to addressing economic challenges while maintaining financial stability. Investors and analysts alike will assess how this auction influences Brazil's economic outlook, foreign exchange reserves, and debt management strategies.

With this auction, Brazil's central bank continues to play a pivotal role in the country's economic landscape, ensuring liquidity and fostering investor confidence in the face of global uncertainties.

Toyota Retains Global Auto Sales Crown in 2025 With Record 11.3 Million Vehicles Sold

Toyota Retains Global Auto Sales Crown in 2025 With Record 11.3 Million Vehicles Sold  Nvidia’s $100 Billion OpenAI Investment Faces Internal Doubts, Report Says

Nvidia’s $100 Billion OpenAI Investment Faces Internal Doubts, Report Says  Pentagon and Anthropic Clash Over AI Safeguards in National Security Use

Pentagon and Anthropic Clash Over AI Safeguards in National Security Use  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  NVIDIA, Microsoft, and Amazon Eye Massive OpenAI Investment Amid $100B Funding Push

NVIDIA, Microsoft, and Amazon Eye Massive OpenAI Investment Amid $100B Funding Push  CSPC Pharma and AstraZeneca Forge Multibillion-Dollar Partnership to Develop Long-Acting Peptide Drugs

CSPC Pharma and AstraZeneca Forge Multibillion-Dollar Partnership to Develop Long-Acting Peptide Drugs  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Apple Forecasts Strong Revenue Growth as iPhone Demand Surges in China and India

Apple Forecasts Strong Revenue Growth as iPhone Demand Surges in China and India  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Bob Iger Plans Early Exit as Disney Board Prepares CEO Succession Vote

Bob Iger Plans Early Exit as Disney Board Prepares CEO Succession Vote  Boeing Secures New Labor Contract With Former Spirit AeroSystems Employees

Boeing Secures New Labor Contract With Former Spirit AeroSystems Employees  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Meta Stock Surges After Q4 2025 Earnings Beat and Strong Q1 2026 Revenue Outlook Despite Higher Capex

Meta Stock Surges After Q4 2025 Earnings Beat and Strong Q1 2026 Revenue Outlook Despite Higher Capex  Thailand Economy Faces Competitiveness Challenges as Strong Baht and U.S. Tariffs Pressure Exports

Thailand Economy Faces Competitiveness Challenges as Strong Baht and U.S. Tariffs Pressure Exports