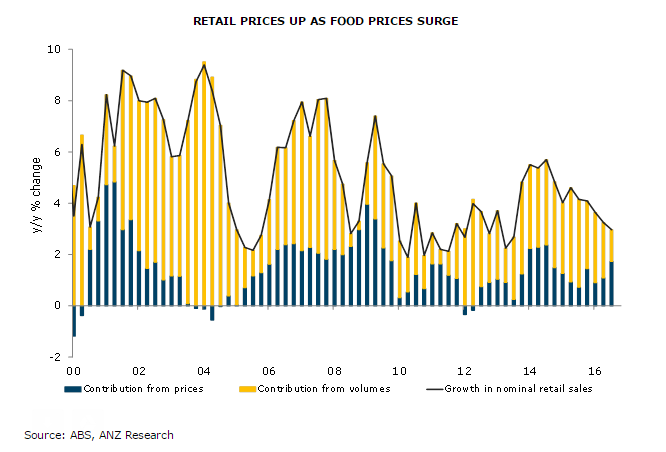

Australian Bureau of Statistics released retail sales report for September on Friday which showed Australia’s retail sales data was a mixed bag. While monthly retail sales surprised on the upside, quarterly retail sales volumes disappointed on the downside. Increase in nominal sales with falling volumes indicates that prices rose over the quarter, as evidenced in Australia’s Q3 CPI report released in late October.

Data showed that nominal retail sales rose a solid 0.6 percent m/m in September beating expectations and following an upwardly revised gain of 0.5 percent in the previous month. In annual terms, retail sales growth lifted to 3.3 percent in September from 2.9 percent in August. Quarterly retail sales volumes fell by 0.1 percent q/q, the weakest reading since June 2014. In annual terms, retail volumes were up 1.2 percent, the weakest rate since December 2012.

The quarterly sales volumes feed directly into household consumption in Australia’s Q3 GDP. Retail sales account for around 30 percent of total household consumption, the single-largest component within Australian GDP. Today's disappointment on retail sales volumes raises a warning flag about domestic household spending and is not a good sign for the nation's September quarter GDP report.

The Reserve Bank of Australia (RBA) this week left interest rates on hold at 1.50 percent given evidence of broad strength in the economy, and cited solid confidence level in its decision. Upcoming U.S. elections raise the potential for financial market volatility which is evident in the falling ANZ-Roy Morgan Australian consumer confidence index in recent weeks. RBA is likely to closely monitor confidence readings in the coming months.

RBA’s quarterly statement on monetary policy (SoMP) which was released alongside the retail sales report showed that the central bank kept its economic growth and inflation forecasts virtually unchanged in its November Monetary Policy Statement (SoMP), signalling no near-term rate cut. RBA expects GDP growth to be around 2.5 to 3.5 percent by end-2017 and around 3 to 4 percent by end-2018, unchanged from the August forecast. Additionally, inflation is also expected to stay steady in the near term, likely to rise gradually to 2 percent by end-2018. The underlying inflation is forecasted to climb 1.5 percent by end-2016 and to reach around 1.5 to 2.5 percent by end-2018.

"Today’s data raise a warning flag for private consumption, which disappointed in the Q2 National Accounts. With the RBA cautious about the outlook for household spending, incoming data on this part of the economy will be a key focus," said ANZ in a report to clients.

Benchmark Australia's S&P/ASX index closed 0.90 percent lower at 5,178.60 points. AUD/USD was trading at 0.7686, 0.06 percent higher on the day at around 12:30 GMT.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient