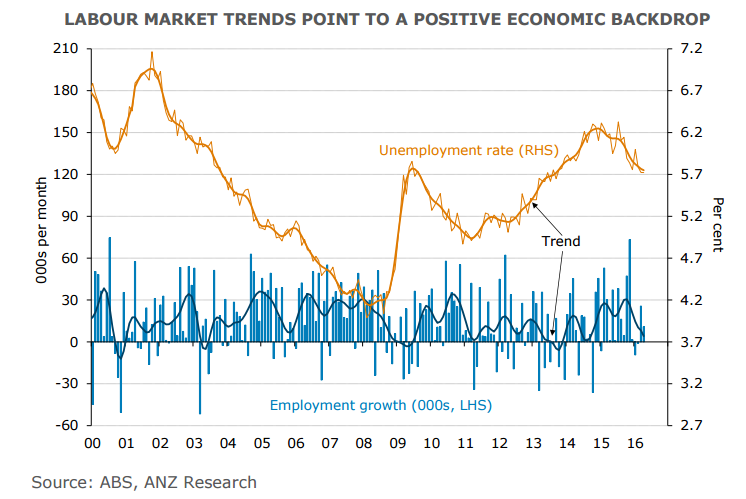

Report from the Australian Bureau of Statistics on Thursday showed Australia's jobless rate came in unchanged at 5.7 per cent in April, compared to median forecast for a rise to 5.8 per cent. The bureau said its seasonally adjusted workforce participation rate fell to 64.8% in April from 64.9% in March, below consensus expectation of 64.9%. 10,800 jobs were added in the month versus expectations of 12,000. The reading for March was also revised down, from 26,100 to 25,700. Full time employment fell 9,300, while part-time jobs rose 20,200.

"The April Labour Force report showed that labour market conditions remain okay, but momentum has slowed. While labour market indicators remain mixed at the moment, we continue to expect the unemployment rate to remain close to the current 5.7% for the rest of the year." said ANZ in a research report.

Despite some slowdown in momentum in jobs growth, the stability in the unemployment rate at 5.7% suggests that the labour market remains in good shape. The lack of wage pressure has helped provide an underpinning to a surprisingly resilient labor market. Data earlier this week showed that Australian wages grew at a mere 0.4 percent in Q1, their slowest pace on record last quarter. Deceleration in wages growth leads to reduced cost pressures for businesses and hence ongoing downwards pressure on inflation.

Australia's reserve bank is likely to look through a resilient labour market report which will probably see no significant monetary policy implications. Speculation is high that the RBA will cut interest rates further in coming months. Cash rate futures currently put the odds of a further 0.25% rate cut from the RBA in August at 73%, unchanged from earlier in the session.

Lack of price pressures remains a major concern for the central bank. Australia experienced deflation for the first time in the first quarter. The broad-based nature of the price weakness prompted the RBA at its SoMP to lower its inflation forecasts radically for the next two years. Data shows that record low wages growth is helping to support hiring, but is also underpinning issues surrounding low inflation.

"Today’s numbers are unlikely to change the RBA’s view on the outlook; its focus has tilted more sharply towards inflation and we continue to expect another cut in the cash rate in August." note ANZ in a report to clients.

Following the release of the report the Australian dollar slipped below the 0.72 handle to hit session lows at 0.7191 and was trading at 0.7202, at 0840 GMT. The ASX 200 closed down 0.60%, relatively unchanged from where it was trading prior to the release.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.