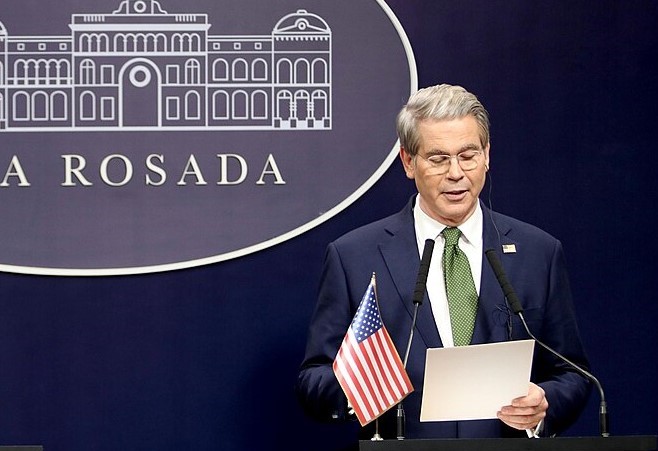

U.S. Treasury Secretary Scott Bessent announced an extension of extraordinary cash management measures to avoid breaching the federal debt ceiling, pushing the deadline to July 24. In a letter to congressional leaders, Bessent said the ongoing “debt issuance suspension period,” previously set to expire Friday, will be prolonged. This move allows the Treasury to temporarily halt investments in certain federal pension and retiree healthcare funds, helping preserve cash to meet immediate obligations.

Bessent has repeatedly warned that without congressional action to raise or suspend the debt limit, the U.S. could run out of funds to pay its bills sometime between mid-to-late summer. Though no specific update was provided, he noted that the estimated “X-date” could shift depending on court rulings related to President Donald Trump’s tariffs, which brought in a record $23 billion in customs revenue in May.

The Treasury’s extension appears to be a strategic move to pressure lawmakers to address the debt ceiling as part of a sweeping tax-and-spending package before Congress begins its August recess. Failure to act, Bessent emphasized, could jeopardize the U.S. government's ability to meet its financial obligations.

“Based on our current estimates, we continue to believe that Congress must act to increase or suspend the debt ceiling as soon as possible before its scheduled August recess to protect the full faith and credit of the United States,” he said.

The debt ceiling standoff adds fresh urgency to Washington’s fiscal agenda as the nation inches closer to default. Investors and economists are watching closely, as political gridlock over the issue could trigger financial instability and impact global markets.

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Justice Department Removes DHS Lawyer After Blunt Remarks in Minnesota Immigration Court

U.S. Justice Department Removes DHS Lawyer After Blunt Remarks in Minnesota Immigration Court  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Minnesota Judge Rejects Bid to Halt Trump Immigration Enforcement in Minneapolis

Minnesota Judge Rejects Bid to Halt Trump Immigration Enforcement in Minneapolis  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump Family Files $10 Billion Lawsuit Over IRS Tax Disclosure

Trump Family Files $10 Billion Lawsuit Over IRS Tax Disclosure  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out