Just a week after President Donald Trump signed the “Big Beautiful Bill” into law, the U.S. Treasury surprised markets with a rare budget surplus for June 2025. The federal government reported a $27 billion surplus—the first monthly surplus in eight years—defying economists’ forecasts of a $41.5 billion deficit.

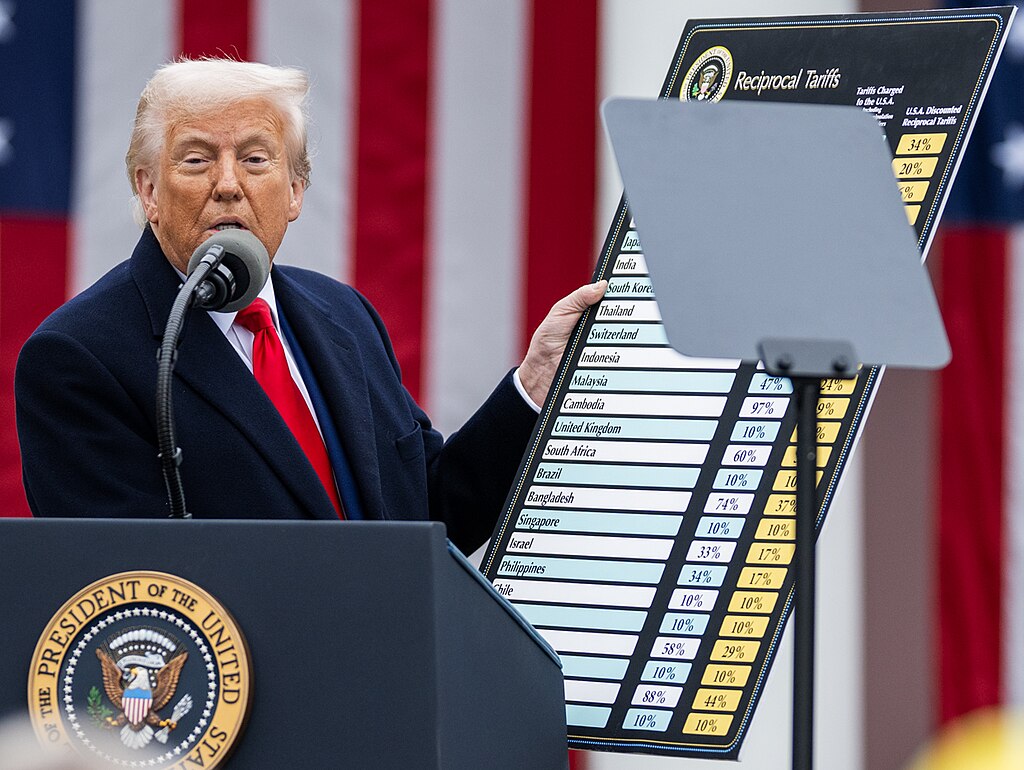

The surplus was fueled largely by a surge in tariff revenues, driven by Trump’s aggressive trade policies. Customs duties reached $27 billion in June, up from $23 billion in May, and up a massive 301% from June 2024. Year-to-date, the government has collected $113 billion in tariffs, marking an 86% increase compared to the same period last year. Much of the jump stems from the 10% blanket import tariff imposed in April, alongside targeted tariffs on nations like Canada, China, South Korea, and Japan.

Despite the positive June data, the U.S. continues to face deep fiscal challenges. The federal deficit for the fiscal year remains above $1.34 trillion. A major driver of the imbalance is ballooning interest payments on the national debt, which totaled $84 billion in June alone and have hit $749 billion so far this year. Interest is now the second-largest federal expense after Social Security and is projected to reach $1.2 trillion by year-end.

President Trump has urged Federal Reserve Chair Jerome Powell to lower interest rates, claiming it would significantly cut debt servicing costs and help reduce the overall deficit. While the June surplus offers a short-term boost, long-term fiscal sustainability remains in question as borrowing costs soar. Investors and policymakers alike are watching closely to see whether Trump’s trade and fiscal strategies can deliver lasting economic results.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions

NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Rejects Putin’s New START Extension Offer, Raising Fears of a New Nuclear Arms Race

Trump Rejects Putin’s New START Extension Offer, Raising Fears of a New Nuclear Arms Race  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday