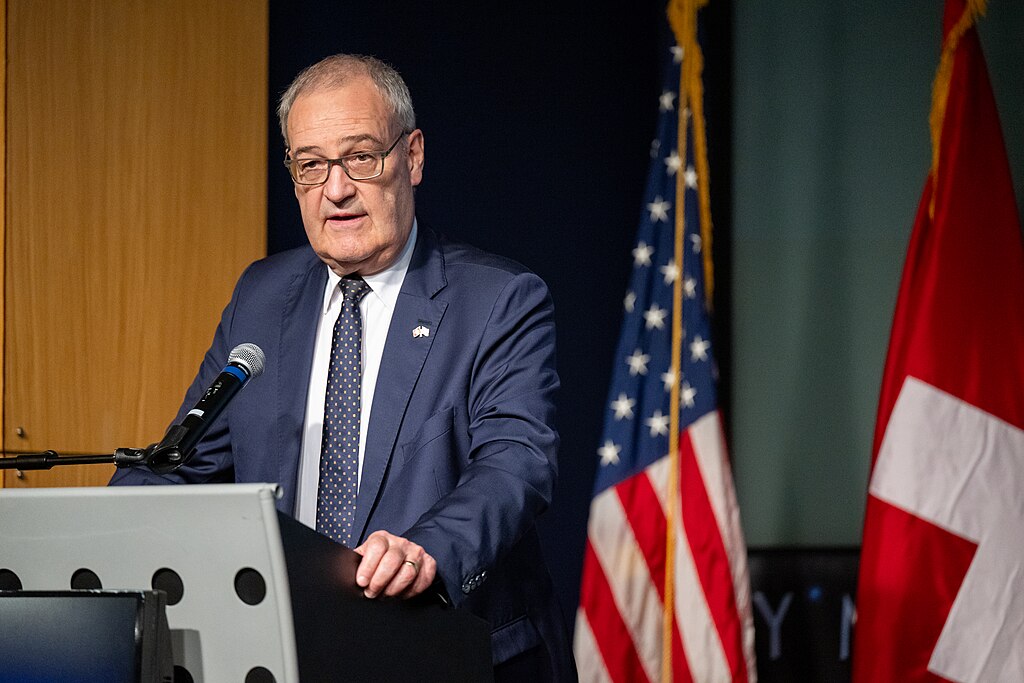

Switzerland is preparing for a significant reduction in U.S. import tariffs, with Swiss Economy Minister Guy Parmelin stating that the current 39% general tariff on Swiss goods could drop to 15% as soon as early December. In an interview with Swiss broadcaster SRF, Parmelin noted that Switzerland has already completed its part of the process, while the United States is still finalizing the necessary steps. He added that although the timeline depends on U.S. implementation, he remains hopeful the new tariff rate will be active within the next few weeks.

Earlier this week, Parmelin told the Aargauer Zeitung that Switzerland anticipates a 10–12 working day processing period for the updated tariffs to be integrated into the U.S. system. However, he emphasized that giving an exact date remains difficult due to procedural uncertainties on the American side.

The expected tariff reduction follows a preliminary agreement reached on November 14 between Switzerland and the United States. The deal comes more than three months after U.S. President Donald Trump imposed a steep 39% tariff—the highest rate applied to any European nation—on imports from Switzerland. The upcoming reduction is anticipated to ease tensions and restore more favorable trade conditions between the two countries.

Parmelin also indicated that negotiations are far from over. He revealed that Switzerland will soon engage in more detailed discussions with the U.S., aiming to secure additional exemptions from the proposed 15% tariff. According to him, Switzerland still sees room for improvement and will push for further concessions to protect its exporters and stabilize bilateral trade.

By continuing to advocate for reduced trade barriers and expanded exemptions, Switzerland hopes to strengthen its economic ties with the U.S. while safeguarding the competitiveness of Swiss-made products in the American market.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices