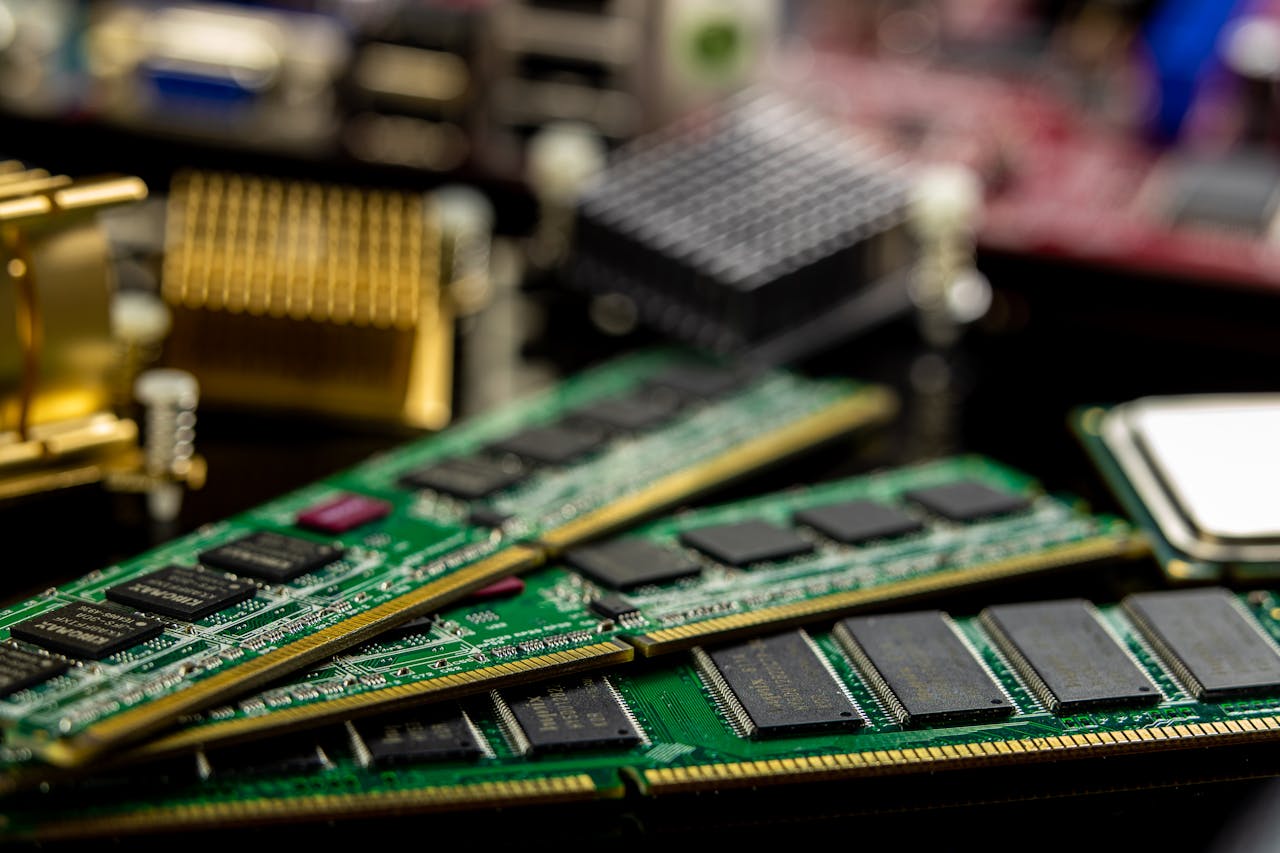

South Korea has expanded its support package for the semiconductor industry to 33 trillion won ($23.25 billion), marking a 27% increase from the 26 trillion won initiative announced in 2023. The move comes as global chip competition intensifies and policy uncertainties grow under the current U.S. administration.

A joint statement from multiple ministries, including the Ministry of Trade, highlighted that financial assistance for the chip sector will now reach 20 trillion won, up from the previous 17 trillion won. The goal is to help domestic chipmakers manage rising costs and enhance competitiveness in a global market increasingly dominated by Chinese rivals.

As the world’s fourth-largest economy, South Korea remains a dominant player in memory chips, led by giants Samsung Electronics and SK Hynix. However, the country is facing challenges in areas like chip design and contract manufacturing. In 2024, semiconductor exports reached $141.9 billion—21% of South Korea’s total exports—with $46.6 billion shipped to China and $10.7 billion to the U.S.

U.S. President Donald Trump recently announced plans to unveil new tariff rates on imported semiconductors, with some flexibility for certain companies. In response, South Korea’s Finance Minister Choi Sang-mok emphasized plans to engage in dialogue with U.S. officials over the Section 232 investigations into semiconductors and biopharmaceutical imports to mitigate negative effects on Korean firms.

Last week, Seoul also introduced emergency support for its auto industry, including tax cuts, subsidies, and financial assistance, aiming to cushion the impact of potential U.S. tariffs. The government reiterated its commitment to negotiating with Washington and diversifying export markets to safeguard its key industries.

This strategic funding boost underscores South Korea's resolve to remain a global leader in semiconductors amid shifting geopolitical and economic landscapes.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans