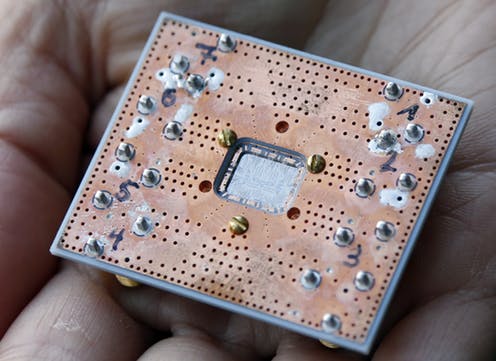

Quantum computing startup PsiQuantum is raising at least $750 million at a $6 billion pre-money valuation, with BlackRock reportedly leading the round, according to sources familiar with the matter. The funding aims to support PsiQuantum’s ambitious plan to mass-produce quantum chips using photonics-based semiconductor manufacturing.

Unlike competitors relying on exotic materials, PsiQuantum leverages traditional photonics technology—commonly used in fiber-optic internet connections—at GlobalFoundries’ New York facility. The company plans to scale production to millions of quantum chips, a costly endeavor requiring significant capital.

Quantum computing promises to solve problems far beyond the capabilities of today’s machines, such as simulating atomic interactions for drug discovery or advanced materials. Big tech players like Google, Microsoft, Amazon, and Nvidia are racing to develop quantum technologies. Just last week, Nvidia announced a quantum research hub in Boston, highlighting the sector’s growing momentum.

PsiQuantum is also collaborating with the U.S. and Australian governments to build two quantum computers—one in Brisbane and another in Chicago. While quantum computers have existed for decades, high error rates have limited their practical use. However, recent breakthroughs in quantum error correction and chip design are bringing commercial viability closer.

PsiQuantum projects it could deliver a useful quantum machine by 2029 or sooner, while Google targets real-world applications within five years. As competition intensifies, PsiQuantum’s photonics-based approach and deep-pocketed backers position it as a strong contender in the quantum race.

With major investments and partnerships, PsiQuantum is on track to play a critical role in shaping the future of quantum computing—an industry poised to redefine scientific discovery, pharmaceuticals, and energy innovation.

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast