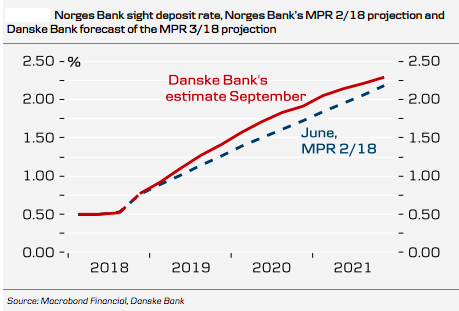

The Norges Bank is expected to raise the sight deposit rate by 25 basis points to 0.75 percent at its monetary policy meeting scheduled to be held on September 20 by 08:00GMT, according to the latest research report from Danske Bank. In addition, the revision of the rate path in the corresponding monetary policy report is likely to be positive, as almost all factors affecting the rate path should be supportive.

However, core inflation has been higher, oil prices have been slightly higher and the money market spread has been a bit lower than expected. Domestic growth has been roughly in line with expectations, but the oil investment survey clearly points to an upside risk for the oil investment forecast, and hence, for the GDP forecast, for 2019. The main positive contribution is from a weaker currency.

However, the central bank has added a factor called ‘judgement’ to the factors affecting the rate path. In short, this includes an assessment of financial stability, including housing market developments, and uncertainty over the policy impact with low rates, the report added.

The latter allows Norges Bank to ‘smooth’ the rate path in order to avoid abrupt shifts in monetary policy, an option that needs to be activated at this time to avoid sending strong hawkish signals.

"Based on these assessments, we expect the new rate path will suggest a somewhat higher than 50 percent probability OF another rate hike in December, 2.5 hikes in 2019, 2 hikes in 2020 and 1.5 hike in 2021," the report further commented.

Meanwhile, as uncertainties tied to the overall outlook for next year remain high, the most interesting part may be the rhetoric regarding the possibility of another hike in December.

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence