They favor expensive foods, posh services and are definitely willing to pay substantial amounts of money on interesting, unique experiences. And more often than not, they are completely unapologetic about their spending habits. Meet the Millennials, aka the generation that was once believed to kill off or damage luxury industries. Turns out, this couldn’t be further from the truth.

Born between 1981 and 1996, Millennials have become the biggest consumers of high-end goods. From opting for expensive morning coffees to ditching public transportation in favor of Ubers and preference towards eco foods, Millennials tend to choose both services and products that come with a higher price tag. As a result, more often than not, Millennials seem to owe more in debt than in have their bank accounts – but that’s not about to stop their spending habits.

Questioning 1,000 Millennials from the US, The Pearl Source conducted the 16-question poll with the goal of understanding Millennial attitudes and shopping habits, with a specific focus on the generation’s preferences for luxury goods and services. The respondents were questioned randomly both via email and phone, with the sample group including men and women ranging in age from 22 to 37. The recent study by The Pearl Source showed surprising results: that more than half Millennials prefer spending their hard-earned money on luxury items instead of necessities such as healthcare. And not surprisingly, Gen Z is closely following the same pattern. The perfect example in this sense is no other than the diamonds industry – in 2017, diamond sales reached a peak of over $80 billion. The ones responsible for this record number: as guessed, the Millennial generation, with more than two thirds of the diamond customers coming from the Millennial and Gen Z groups. And forecasters agree: Gen Z will become an even bigger consumer of luxury goods in just a few years.

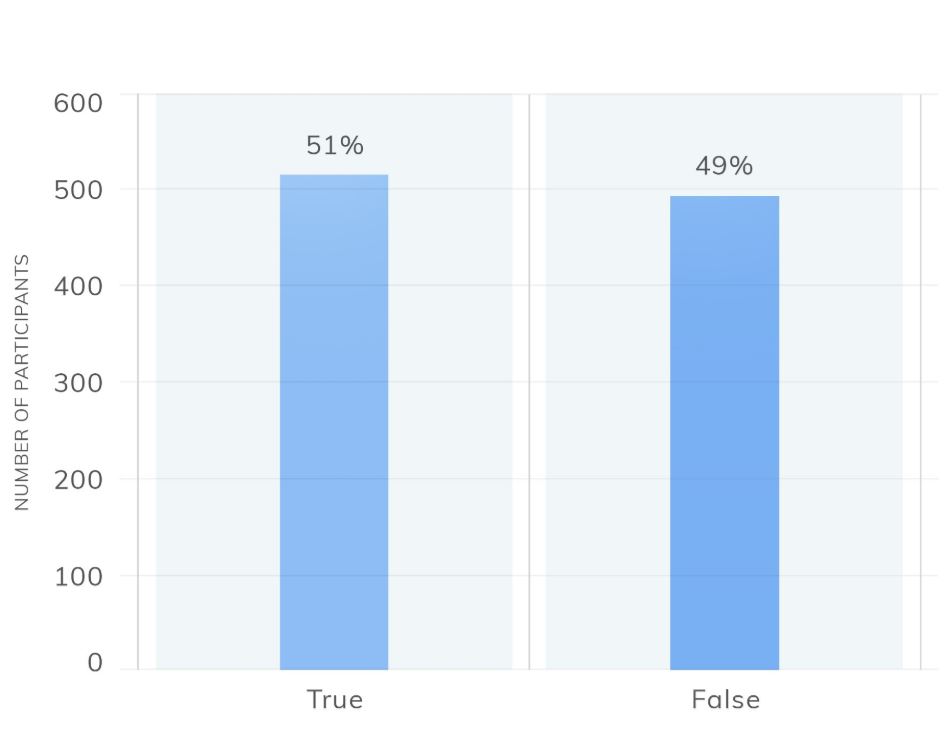

Graph on Millennial spending habits: ‘I’d rather have more disposable income (for entertainment and meals, luxury purchases, or high-end experiences) than a better healthcare plan.’

Image Source: pearlsofwisdom.thepearlsource.com

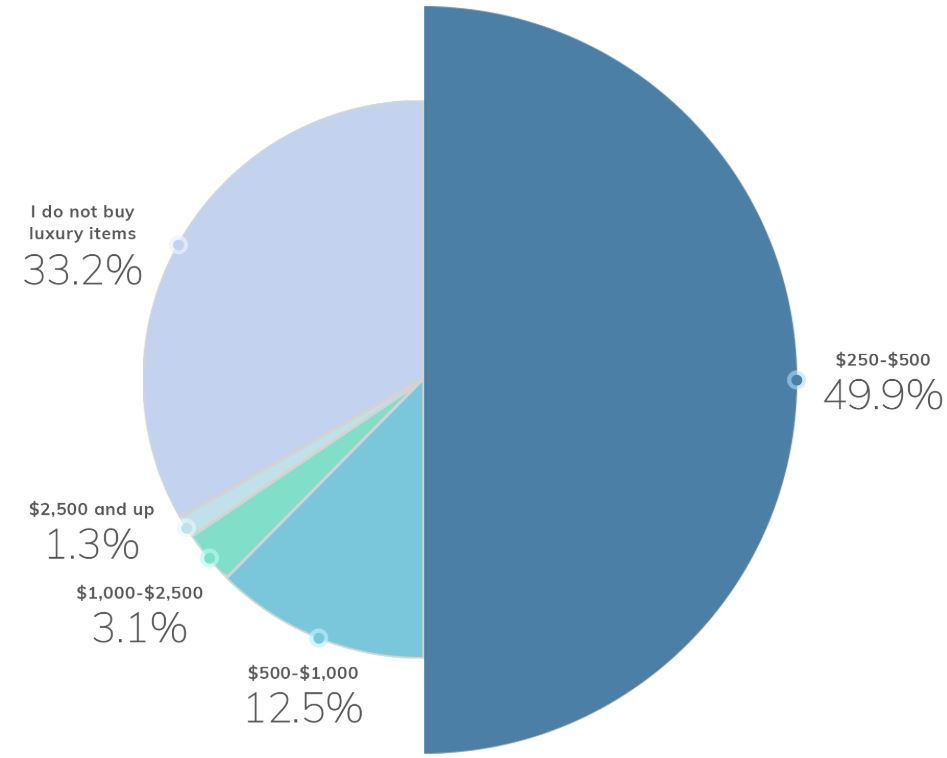

High costs of living as well as low disposal incomes automatically lead to the accumulation of credit card debt – and Millennials are definitely not an exception. Almost half of the surveyed Millennials declared that they had significant credit card debt (46%) – with the majority claiming that student load debt, averaging at $34,000, was the main part of their liability. One of the main findings of the poll revealed that over 50% of respondents had purchased something they could not afford in the past six months. Luxury over necessity seems to be the Millennial mantra – with almost half Millennials claiming that they spend up to $500 per month on luxury items. Not only that, but 57% of the group claim that they would love to buy luxury goods, if a payment plan was available to them. In addition, 36% of Millennials would rather accumulate more debt if that meant that they could acquire a desirable luxury item.

Image Source: pearlsofwisdom.thepearlsource.com

When it comes to jewelry, Millennials look at quality and cost first and at sustainability plus eco-friendly factors second. While that might come as a surprise to most, fact is that contrary to popular belief, only 9% of Millennials take into account ethical and environmental aspects when on a luxury shopping spree. While diamonds are still ranking on top as the most popular luxury gem, 46% of Millennials prefer to invest in alternative jewelry pieces such as pearls, sapphires and rubies. And when it comes to engagement or wedding rings, Millennial spending habits remain on the same track, with over 70% of the respondents stating that they had to take on debt in order to purchase said luxury item. Out of this group, 35% of Millennials stated that they managed to pay the engagement ring within 12 months after acquiring it.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe