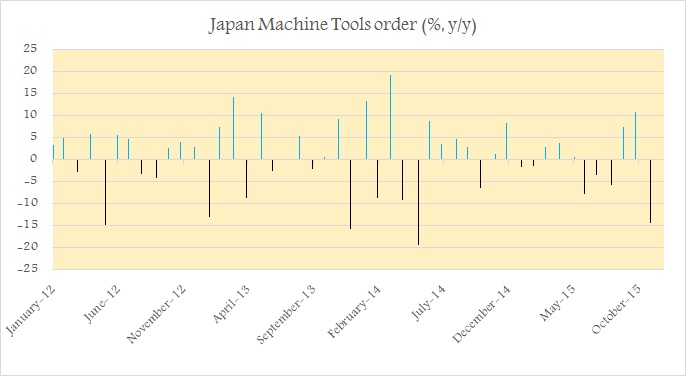

Abenomics, which is set of policies introduced in Japan, which includes ambitions such as bringing inflation back in Japan, increase sales tax to balance budget might be losing its charm, at least November's Machine tools orders, which is synonymous to capital expenditure in Japan, would say so.

In November, Japanese Machinery orders recorded, sixth decline for the year. Though the data is usually volatile and moves on both side of zero, regularly, a double digit decline is relatively rare. November's 14.4% decline is biggest since May, 2014 and third double digit decline in last five years or more.

Machinery orders till November has declined in six of the 11 months and drop has been much more frequent and large since 2014, posing considerable doubts on Abenomics' ability to boost back growth.

On the other hand, despite Bank of Japan's (BOJ) sincerest efforts and purchase of ¥80 trillion assets per annum falling far short of boosting inflation. Consumers have cut back on purchases in response to higher price.

According to last night's data, corporate goods price dropped -0.3% in December, down -3.4% from a year ago.

Nikkei dropped sharply in response to bad data, at once point was down as much as 4%, while Yen is relatively strong, trading at 117.8 per Dollar.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns