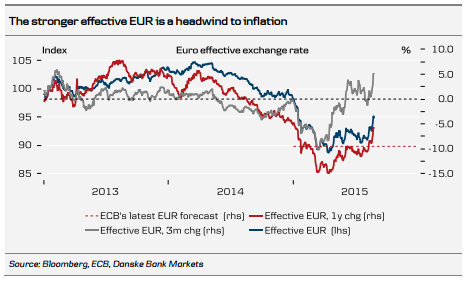

The ECB's outlook for higher inflation is threatened by a renewed trend higher in the effective EUR, which, when considering the 3M change, is at the highest rate in more than two years.

The upward pressure on the EUR has strengthened after People's Bank of China has joined the global currency war and together with an expected later lift-off from the Fed, there is pressure on the ECB to express a dovish stance with the aim of weakening the exchange rate. The ECB's new inflation projection will not include the latest strengthening of the EUR in the second half of August and overall the exchange rates will not change the updated forecast for inflation significantly, says Danske Bank.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal