Balance of Trade data released today from Australian Bureau of Statistics painted another bleak picture for Australian economy. Trade deficit widened to lowest since last April. For December, Trade deficit came at $3.535 billion. In 2015, Australia's trade deficit now stands at $31.16 billion, which in lowest on record.

While drop in commodity prices have been a major drag for the economy, real weakness is stemming from China.

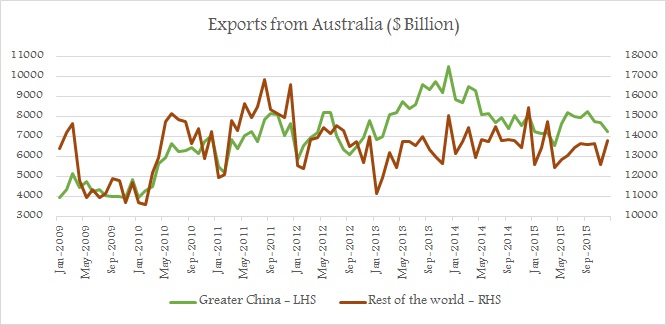

Detailed report shows, Australia's exports to China has dropped significantly, as shown in figure, especially since 2013.

Australia's monthly exports to rest of the world, excluding China have jumped up from $11.14 billion in January 2013 to $13.8 billion as of December, with peak around $15.5 billion in December 2014.

Compared to that, Australia's monthly exports to Greater China (Mainland, Macau, Taiwan, and Hong Kong) have dropped from $10.5 billion in December 2013, to $7.26 billion as of last December.

Despite the drop, China still contributes to 35% of overall exports of Australia, which is much lower than 43% seen during 2013 but significant enough to provide further drag. So further weakness in China will still be a major concern for Australia's export oriented economy.

Australian Dollar is currently trading at 0.705 against USD.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains