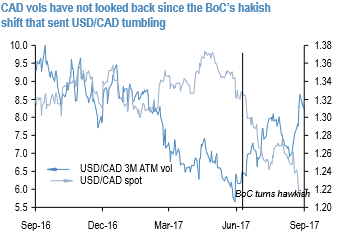

GBP spot and vols blown up to the advanced level late in the previous week following a hawkish turn from the BoE. We were mulling owning GBP gamma earlier given the potential breakout set-up in cable prior to Vlieghe’s speech, and due to more fundamental ambiguity regarding the wisdom or otherwise of rate hikes in the face of cyclically weak UK consumption. The gamma train has well and truly left the station but the macro case for BoE uncertainty still holds, and our sense is that this shift higher in vol represents a quasi-permanent state change, much as CAD vols experienced since BoC's hawkish pivot in June (refer above chart).

There are good reasons to think that macro parallels between Canada and the UK are flawed, yet markets appear to have latched onto a common narrative of normalization of emergency rate settings that could yet have legs.

More importantly from a vol perspective, sufficient daylight has now opened up between current levels and the previously stable 1.28-1.30 range in cable such that the potential range of sterling moves and hence realized volatility has expanded, especially if there were to be a broad dollar upturn and/or a reversal/pullback in UK rate pricing. Even without such a re-assessment, a test and even overshoot of 1.40 on GBPUSD is not out of the question if markets test the BoE's tightening resolve, as is not uncommon during monetary policy inflections.

In sum, the distribution of potential spot states has widened after events this week, and higher GBP vols ought to reflect this dispersion of outcomes till a stable equilibrium of BoE views is reached.

While the British Foreign Secretary Boris Johnson will hopefully not take it personally that Sterling appreciated briefly yesterday in reaction to reports he might resign. I continue to interpret the exchange rate moves in such a way that Sterling will benefit whenever the likelihood of Great Britain continuing to enjoy far reaching access to the European single market rises. Even though Sterling was unable to maintain the gains, yesterday’s developments illustrate that GBP investors are focused on May’s speech on Friday. Against this background today’s retail data is likely to fade into insignificance. Courtesy: JP Morgan

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook