In the recent past MXN eased remarkably against the dollar. This was majorly due to the appointment of important posts for the US Department of Commerce which underpins the protectionist approach of the future US President, as well as the decision of a US car manufacturer not to set up a factory in Mexico. Yesterday the central bank finally intervened and tried to support MXN with the help of USD sales. The effect wore off quickly, as the uncertainty about US trade policies is too high.

Particularly as Trump now focused on the next car manufacturer (Japanese this time) that planned to invest in Mexico. But the central bank at least demonstrated that it is prepared to dampen excessive MXN depreciation. Last year it hiked interest rates notably in support of the peso. If anything the environment has become even more difficult for the peso and as a result further rate hikes and possibly other measures will become necessary.

Banxico's efforts to stabilize the MXN through intervention last week are a short term fix, but insufficient to knock out sticky medium term long USD-MXN positions.

However, as became clear recently any central bank measures may have a short term calming effect, thus preventing possible dramatic depreciation. But in principle even that cannot prevent a weaker peso if the news from the US remains worrying from a Mexican point of view.

Hedging Strategy:

After weekend’s correction in USDMXN from the highs of 21.6226 levels, the pair takes support at 7DMA (i.e. around 21.2052) and showing strength to resume its previous bullish rallies, for now, the major uptrend appears to be robust and likely to prolong further.

While ATM IVs of this pair is substantially spiking higher above 17.5% and 16% for 10d and 1m tenors which is conducive for the holders of the call options, but using the minor dips in this underlying pair writing narrowed tenor OTM calls would reduce the cost of hedging.

Thus, using any abrupt dips, initiate a diagonal debit/bull call spread (DDCS) at net debit.

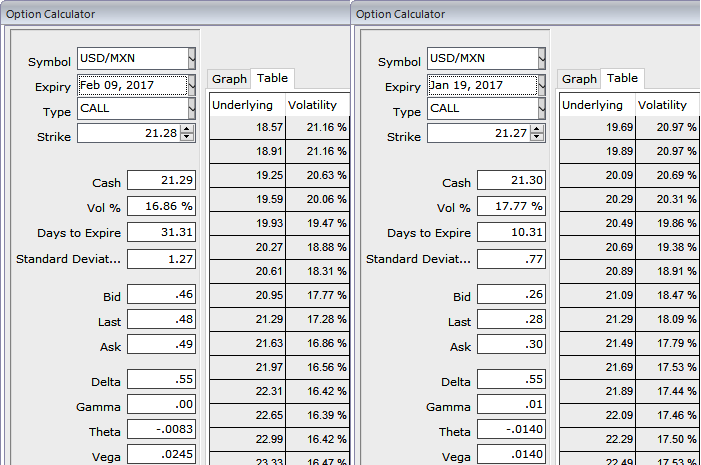

The execution: Initiate shorts in 1W (1%) out the money calls with positive theta, simultaneously, buy 1M (1%) in the money 0.51 delta call option. Establish this option strategy if USDMXN spot FX is either foreseen to be in sideways or spike up considerably over the next month but certainly not beyond your upper strikes in short run.

As shown in the diagram, a typical call spread likely to fetch yields as long as it keeps spiking up to OTM strikes, which is why we’ve chosen shorter tenors on short leg and advocated longer tenor on the long leg.

Please be noted that the tenors shown in the diagram is just for demonstration purpose only, use accurate tenors as stated above.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty