In terms of sterling’s currency markets, GBP crosses fell by around 1.14% yesterday versus the USD and euro but regained today slightly about 0.17%. Moves lower in the currency may be partly due to some caution/uncertainty on markets ahead of tomorrow’s BoE meeting which is likely to stand pat in its monetary policy (official bank rates likely to remain at 0.25%).

On the data front, yesterday’s modestly softer than expected UK CPI inflation data for August (+0.6% vs forecast +0.7%) also coincided with some sterling weakness. In level terms, cable (GBP/USD) fell from its opening above $1.33 to near $1.32. The softer tone to sterling saw EUR/GBP trade up around the 85p mark.

In the day ahead, the focus will remain on sterling with a raft of key UK labour market figures due (incl. employment, unemployment, and earnings). The figures will be assessed for any signs of negative impact on the jobs front following the Brexit referendum.

Option-trade recommendation:

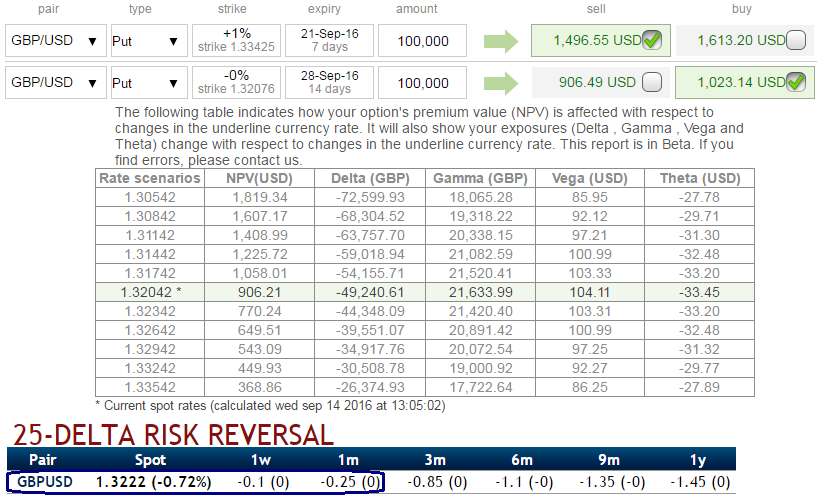

The rationale: Upside potential is limited in short run as you can see neutral risk reversals in 1 expiry with negative sentiments in OTC over long-term tenors and this should be cushioned & used for shorts during reducing volatility times,

Thereafter, to favour major downtrend, dips should optimally be utilized so as to participate in that major trend.

Thereby, the profitability can be maximized for every shift towards downside and this is not the same on upside.

The current ATM implied volatility is creeping up at 9.65% for 1W.

Execution: Keeping risk reversal, IV and trend factors in mind, it is advisable to go long in 2W ATM -0.49 delta put while writing 1W (1%) ITM put with positive theta and delta closer to zero (both sides use European style options).

This credit put spread option trading strategy is recommended when the spot FX is anticipated to inch higher moderately in the near term and not prolonged in the long term but continue with long term downtrend.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence