Before we begin with this write-up, please go through our previous article on this pair:

We had advocated a hedging piece on any abrupt CNH appreciation, accordingly, you could observe since January 3rd CNH gained substantially.

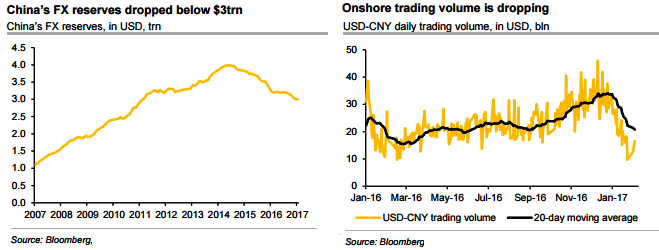

The China’s FX reserves dipped below the USD3trn watermark in the first month of 2017. Indeed, China has burnt down USD1trn FX reserves to conduct direct FX market intervention since mid-2014. However, this has not changed the market expectations over CNY exchange rates.

FX reserves dipped to below $3trn China’s FX reserves dropped below the psychological level of USD3trn at the end of January, at USD2.998trn, from USD3.01trn in the prior month. This is the first time since February 2011 that China’s FX reserves have fallen below USD3trn. Clearly, capital outflow pressures remain despite the presence of supportive factors.

First, EUR and JPY appreciated 2.7% and 3.7% against the USD respectively in January, which should increase China’s FX reserves to gain USD30bln from a valuation perspective (we assume that 2/3 of China’s FX reserves are in USD, 20% in EUR, 10% in JPY).

Second, China’s central bank actually reduced the outright intervention in both onshore and offshore markets over the past few months, which should have helped to slow down the decline of reserves. Instead, they conducted administrative measures to reduce USD purchase flows in the onshore market, while increasing the cost of shorting CNH in the offshore market to fight against market speculators;

Third, due to Chinese New Year holidays, there were fewer trading days in January, and the corporates are normally less active during holiday seasons. In fact, the trading volume on the onshore market also dropped dramatically in January.

(Refer above chart) Nonetheless, the fact that China holds less than USD3trn FX reserves right now means that China has to rethink its intervention strategy. Since mid-2014, China’s central bank has burnt down almost USD1trn FX reserves to conduct the market intervention. However, it does not make too much sense as the market expectations are unlikely to be changed.

Well, for now, we advocate upholding below hedging vehicles:

Buy USDCNH 1y topside seagull, strikes 6.80/7.20/7.50, zero cost (indicative, spot ref: 6.8330), the structure is a standard 1y call spread strikes 7.20/7.50 fully financed by selling a put strike 6.80, exposed to a maximum USDCNH appreciation of 4.2% at expiry.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One