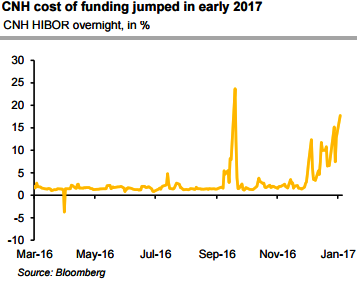

What occurred at the start of 2017 evokes the market anarchy in early 2016. This morning, Chinese offshore currency (CNH) overnight HIBOR spiked to 18.5%, a signal that China’s currency is under great pressure again. Liquidity tightening is a typical phenomenon when the currency is facing huge sell-off pressure – people borrow one currency and short, which pushes up the cost of funding.

Of course, the intervention from the central bank, if there is, will tighten the CNH liquidity as well. There is no doubt that China still faces strong capital outflows, and the reactions from Chinese authorities are to tighten the capital control measures.

This won’t sort out the problems fundamentally, as the root reason of capital outflows is the extremely expensive domestic asset prices and poor real returns of these assets.

In fact, the Chinese authorities have realized this issue and have turned its policy focus to “bubble deflating” in the coming year. This makes sense, but short-term pain is inevitable.

One should clearly understand that the recent upmove in USDCNY is largely a reflection of USD strength rather than CNY weakness. USDCNY appreciated in line with broad USD appreciation. US officials cannot reasonably claim that China is deliberately weakening CNY. A simple comparison between USDCNY and the CFETS RMB index shows that during October and November the weighted basket remained effectively flat, whereas USDCNY appreciated in line with broad USD appreciation.

On the contrary, any abrupt CNY appreciation is only deemed as the effects of the selling FX reserves to prevent severe CNY weakness.

CNH Option strategies on hedging grounds:

Buy USDCNH 1y topside seagull, strikes 6.90/7.20/7.50, zero cost (indicative, spot ref: 6.95), the structure is a standard 1y call spread strikes 7.20/7.50 fully financed by selling a put strike 6.90, exposed to a maximum USDCNH appreciation of 4.2% at expiry.

Buy USDCNH 1y call spread strikes 6.90/7.80, (spot ref: 6.9268) This longer-term trade positions for further CNH depreciation, generating a maximum leverage close to 6 times beyond 8.00 in one years.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target