NZD underperformed on a broad basis this week, and against both AUD and CHF. There has been little in the way of new information surrounding the RBNZ’s plans for potential LSAP expansion and the prospect for foreign asset purchases, which leaves market participants less

than two weeks to price the potential prospects of FX intervention. We maintain that, even if hedged, there may be sufficient opacity in the RBNZ’s details surrounding the program such that there is a sizable currency impact on the announcement; overnight vols continue to price around 0.8% in breakevens for the day. NZD is still relevantly buoyant, particularly on a TWI basis given NZD/CNY, which could be both a concern and motivation for the central bank going into August.

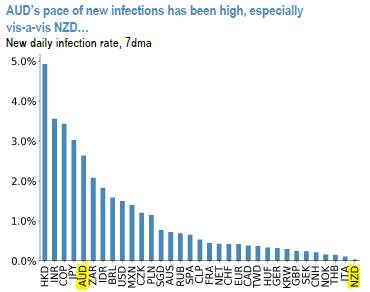

Still, tactical considerations prompt us to take profit on this week. Downside risks in AUD are clearly visible based on relative virus management and the associated economic costs. Australia currently has among the highest rates of new infections in the world, compared to

a negligible rate in NZD (refer 1st chart), while more complete shutdowns in Victoria illustrate the potential for significant economic reversion for government-mandated closures (refer 2nd chart). Indeed, this has prompted our economists to revise down the 3Q growth forecasts for Australia, highlighting the potential for cyclical divergence between AUD and NZD. Nonetheless, selling NZD into the August RBNZ meeting remains prudent, and so we roll our shorts into a new NZD/NOK short in cash, which extends our aforementioned preference for pro-cyclical, EUR-proxy exposure that also has relatively stronger structural underpinnings than NZD. Pairing two high-beta currencies also neutralizes some of the exposure to the risk backdrop, and should perform if the market more actively prices the prospect of foreign asset

purchases into the Aug 12 RBNZ meeting.

Trade tips:

Square-off short NZD vs a 50:50 basket of AUD and CHF at a profit. Marked at +1.34%.

Rotate into short NZD/NOK. Entry at 6.0442. Stop loss at 6.2104.

Short NZDUSD 1m (1.5%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options capitalizing on the minor upswings in the short-run.

Alternatively, we recommend short hedges staying shorts in NZDUSD futures contracts of September’20 delivery with a view of arresting bearish risks in the major trend (spot reference: 0.6593 level). Courtesy: JPM

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal