As widely anticipated, the NBP kept the main policy rate at 1.50%, while delivering a neutrally toned press statement followed by a rather bullish press conference by Governor Glapinski.

This MPC remains to a large extent focused on growth developments above all, while the bout of negative inflation continues to be seen as a temporary anomaly with no undesired effects at the consumer or investment decision levels.

In that context, it seems that policy easing is not an option being considered. The Q&A was the most interesting bit of the rate-setting decision, in our view, with the Governor repeating the past meeting’s hawkish rhetoric but now specifying that a hiking cycle would be necessary from early 2018 (instead of late 2017).

We expect that GDP growth would stay at 3.0% during 2016 and 2017, which although below the NBP’s projections is within the MPC comfort zone, and hence, insufficient for the board to consider rate cuts again, more so given the hawkish bias displayed by Governor Glapinski.

We expect the NBP will stay on hold throughout 2017.

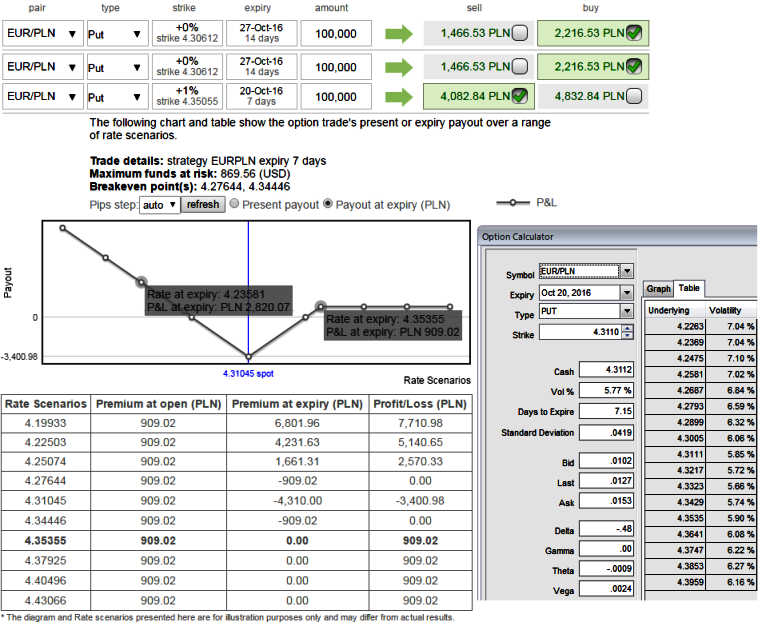

FX Option Strategy:

Although the EURPLN showing strength, the intermediate trend seems to be little weaker and IVs of this pair are on the lower side which is a good sign for option writers capitalizing on momentary upswing sentiments.

To factor in the weakness in this pair, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing ATM longs to construct back spreads choosing narrowed expiries that likely to fetch positive cash flows as shown in the diagram.

Please be sure that a large move in the underlying should be allocated with longer tenor (targets set at 4.2507 levels) and can be withstood without losing any money at break even levels of 4.2764 and 4.3444 levels. This should be of greater concern than doing the spread for reducing debit.

So, here goes the strategy this way, At spot ref: 4.3060, go long in 2 lots 2w ATM -0.50 delta puts, and simultaneously short 1W (1%) ITM shorts, the spread is to be executed in the ratio of 2:1with net delta at around -0.70.

The delta of the strategy is at 70%, which means there is more likelihood of long options expiring ITM on expiration (have a look on sensitivity table), these instruments are the major contributors in the strategy as you can refer %change in premiums and their probabilities to hit the OTM strikes.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms