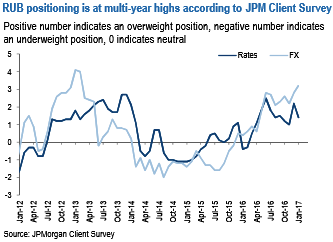

Every good structural story needs a repricing and a clear-out of extended positioning. The medium-term case for Russian local markets is underpinned by high nominal and real interest rates, falling inflation, and a trend of improving macro policy credibility. Yet investors are already positioned to be very long and valuations are only beginning to correct from a starting point of overvaluation (refer above graphs).

In this context, the decision of the CBR to intervene in the FX markets to the tune of $2bn per month is a catalyst for positioning to wash out and a repricing of Russian local rates and currency assets in the short term.

The FX intervention program will be a meaningful drag on the BoP. To put this into perspective, the currently estimated $23bn FX intervention in 2017 compares to our $33bn current account surplus forecast for the year.

The 2015 FX reserve accumulation program resulted in at least 5% RUB depreciation. This is based on the RUB depreciation over the period adjusted for movements in oil and CDS prices.

RUB is overvalued. In our short term FX model, RUB entered the FX intervention announcement trading 2% rich to oil. This has now been corrected to a flat position but we still expect the currency to have to start trading cheap to oil. In our long term REER model, RUB is 5% rich.

RUB positioning is extended. RUB is now the second most extended long globally after BRL.

Oil positioning is extended. Net longs in crude are at their highest levels since mid-2014 increasing risks for a correction. While the new intervention policy should eventually limit RUB’s sensitivity to oil, this will only be the case once RUB reaches its new equilibrium. From current levels, we believe oil price correction is a complementary risk.

To express this view of short-term risks pointing to a repricing and clearing out of long positions, we recommend the following trade: Go long USDRUB with a 63.5 target and 58.5 review level.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran