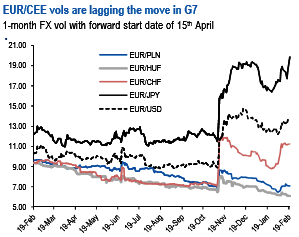

The above diagram explains 1m implied volatility with a forward start of 15 April (i.e. just before the commencement of French presidential elections) for a number of currency pairs.

While G7 currency pairs, including EURUSD, EURJPY, and EURCHF have been moving higher in anticipation of French election risks, EURPLN and EURHUF implied volatility has been grinding lower.

We are modestly bearish PLN against EUR over the medium term. The zloty is currently around fair value, but with a little premium for risks from the potential conversion of FX mortgages and foreign divestment from the banking sector. While growth has been robust lately, the market already prices in more rate hikes than JPM's economists over the next 2 years and thus further support from expectations of tightening monetary policy is limited from current levels.

Polish full-year 2016 growth was reported at 2.8% y/y last week, from which we infer that growth was broadly stable at 2.5%oya in 4Q. This would nonetheless imply a strong pickup in sequential growth to 4.5%-5%q/q, saar from 0.8% in 3Q16. IP and construction output expanded robustly in 4Q16 (6.9% q/q, saar and 18.5%, respectively) while retail sales also rebounded (12.7%). The expenditure-side details available for full-year 2016 suggest that private consumption remained solid, expanding around 4%oya in 4Q, while the contraction in fixed investment eased only marginally.

Initiate longs in a new EURPLN 2m call (4.35), spot ref: 4.3090.

We think it is, therefore, attractive to buy EURPLN call options at current levels, as CEE is vulnerable to contagion from political anxiety in Europe.

EURPLN is close to fair value on our valuation models, and we think the zloty will struggle to rally from current levels.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One