Technically, The upswings to prolong up to 82.786 on break-out above 77.887 with bullish SMA crossover (7DMA crosses over 21DMA).

The current upswings have taken above EMAs as well on monthly plotting, sustenance above would take the rallies to 83.321 levels, otherwise, the failure swings to bring in an equal chance for bears.

New Zealand posted a trade gap of NZD 846 million in October of 2016, compared to a NZD 904 million deficit a year earlier and better than market expectations of NZD 950 million shortfall. It was the smallest gap recorded since July when the trade balance swung into deficit.

While the terms of trade fell in Q3, we believe this will mark the cyclical low now that export commodity prices have lifted. The terms of trade are still at a historically strong level (just 10% off its highs), which is a remarkable outcome considering the earlier weakness in dairy prices. It is a key factor supporting fundamental NZD valuations.

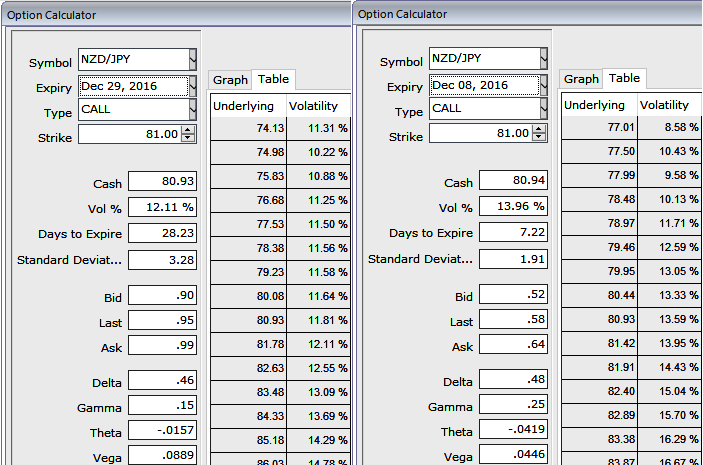

The ATM IVs are the just tad below 14% and shy above 12.10% for 1w and 1m tenors respectively.

While ATM calls of 1w tenor are trading exorbitantly 37.8% above NPV, thus, we could see the disparity between implied volatilities and option pricing at a premium which is significant in choosing as to which option instrument to be considered in hedging strategy.

Hence, we end up stating that one can think of writing such expensive call options and simultaneously, stay hedged deploying in the money +0.51 delta calls with comparatively longer tenor in order to keep upside risks on the check.

The execution: As shown in the diagram, one can go long in 1m (1%) ITM +0.51 delta call, simultaneously, short 1w ATM call and one more (1%) OTM call with the similar expiry, the trades should be entered into the net debit but with reduced cost.

Risk/reward profile:

Maximum returns for this strategy is limited and possible only when spot NZDJPY on expiration date is trading between the strike prices of the call options sold. At this price, while both the long call and the lower strike short call expire in the money, the long call is worth more than the short call.

While losses are limited to the extent of initial debit taken if the spot FX price drops below the lower BEP but large unlimited losses can be suffered should the spot price moves a dramatically towards the upside within next 1 week beyond the upper BEP.

Please be noted that the strikes and tenors shown in the diagram are just for demonstration purpose, use accurate inputs as stated above or as suitable for your exposures.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics