Gold -

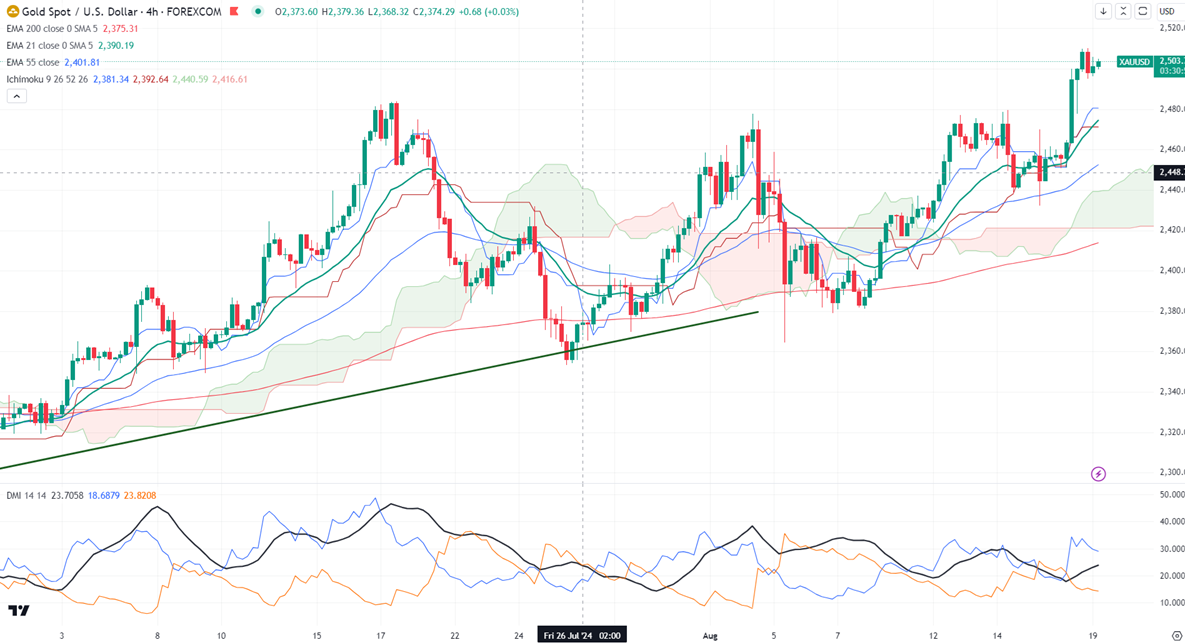

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2447

Kijun-Sen- $2442

Gold gained above $2500 on US dollar weakness.It hit a high of $2509 and is currently trading around $2504.

Markets eye the Jackson Hole symposium this week for further direction.

The easing inflation and weak US economic data have increased the probability of a rate cut by the Fed in Sep.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 71.50% from 50% a day ago.

US dollar index- Bearish. Minor support around 102/100.60 The near-term resistance is 102.50/103.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $2470, a break below the target of $2450/$2430/$2400. The yellow metal faces minor resistance around $2510 and a breach above will take it to the next level of $2554.

It is good to buy on dips around $2450-55 with an SL around $2430 for a TP of $2510/$2550.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields