Gold -

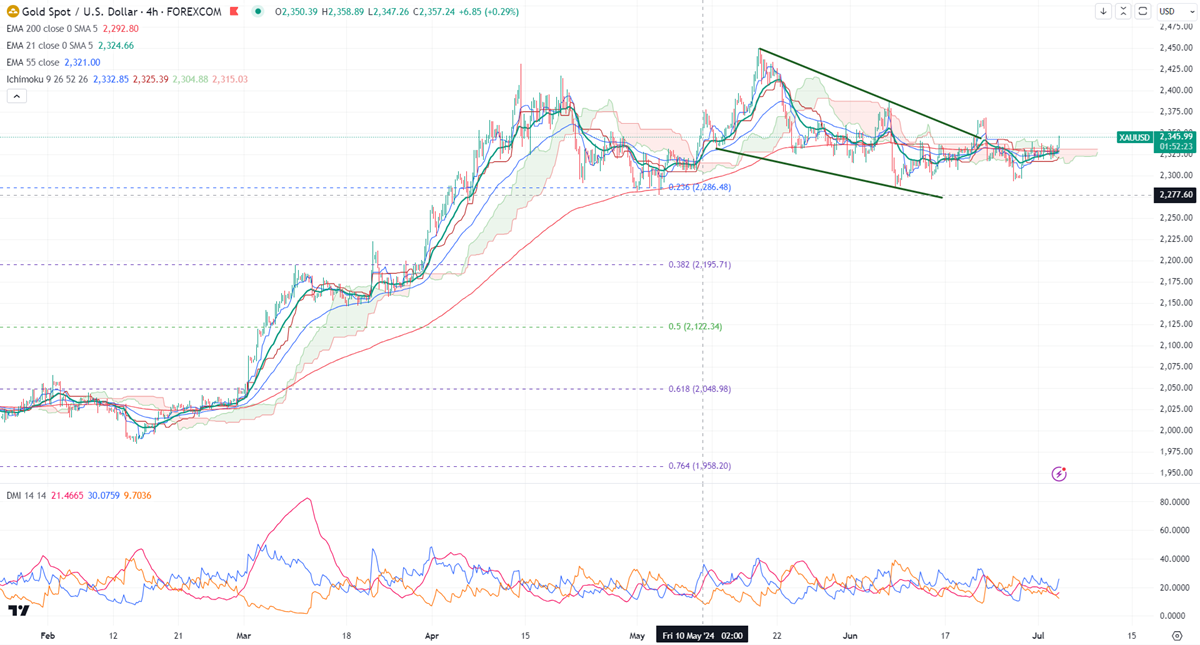

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2328.23

Kijun-Sen- $2318

Gold showed a minor pullback, ahead of the FOMC minutes meeting. It hit a high of $2344 at the time of writing and is currently trading around $2343.

Fed Chairman Powell said in the ECB forum “We've made quite a bit of progress in bringing inflation back down to our target, while the labor market has remained strong and growth has continued,”

Major US economic data -

12:30 pm US ADP employment data, US jobless claims

2 pm US ISM services PMI

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 59.90% from 56.30% a week ago.

US dollar index- Bullish. Minor support around 105.50/104. The near-term resistance is 106.20/107.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $2280, a break below the target of $2260/$2250. The yellow metal faces minor resistance around $2340 and a breach above will take it to the next level of $2360/$2375/$2400.

It is good to buy on dips around $2308-10 with an SL of around $2290 for a TP of $2360.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential