Macro views: In UK, the BoE has been maintaining an unchanged interest rate at 0.50%, all MPC members unanimously voted for this decision.

The main reason behind this decision is that the BoE would not want to put any additional strain on the markets amid Brexit decision ahead in this month and the British economy by allowing any speculation about an adjustment of its monetary policy.

UK manufacturing PMIs have produced prints at 50.1, yesterday, construction PMIs have missed the estimates (actual 51.2 vs forecasts 51.9),while services PMI to show just a modest bounce, we see only a modest bounce in the services PMI to 52.7 in May (from 52.3).

Taken together with the other PMIs released earlier in the week, it would be further confirmation that Q2 GDP growth will be weaker than Q1’s.

Technical glimpse on GBPCAD:

Despite the attempts of upswings in last month the current prices have remained well below EMAs.

It seems intermediary bulls have been exhausted currently as the attempts of bearish crossover on EMAs is spotted, massive volumes are in conformity to the declining trend.

OTC updates & Hedging Frameworks:

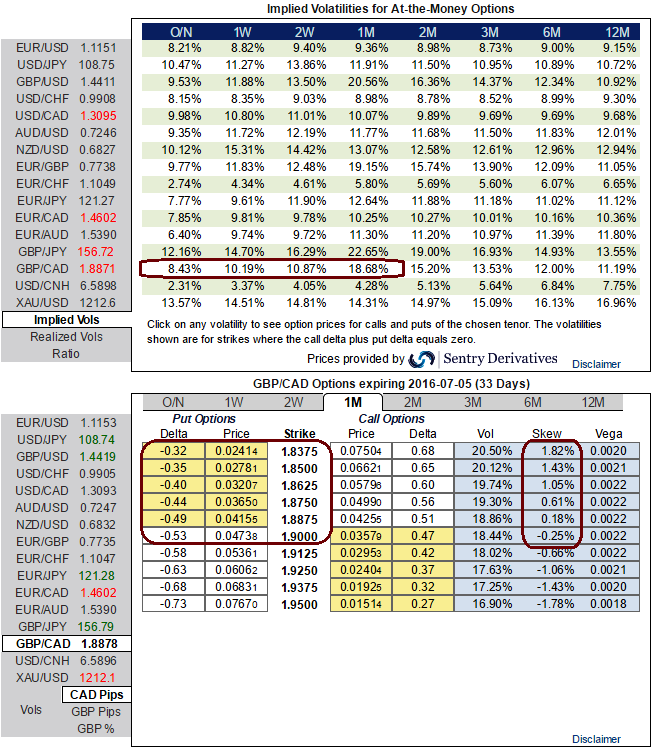

Elsewhere, in OTC markets, ATM IVs of all GBP pairs responding crazily to the economic events (especially brexit outlook) to factor in these weakness in this pair as we could see reasonable increase in IVs of 1M tenors of all GBP crosses, while skews of these vols indicate OTM striking calls may go unproductive as they flash higher negative values.

But as you can observe 1w IVs are just creeping up at 10.19%, if you see for skews in IVs then you will find higher positive flashes in 1m tenors of OTM strikes.

Well, stated in another way, it is the difference in IV between out-of-the-money, at-the-money and in-the-money options and also different expiration periods.

Option premiums will rise and fall with volatility. These pricing models make the incorrect assumption that volatility is constant throughout each respective strike price and regardless of duration. Supply and demand will never allow these conditions to exist.

As a result, we recommend capitalizing on the sustainable rise in IV factor by employing ITM shorts with short tenor puts as there is UK central bank's decision (scheduled on 16th June) and matching this with ATM longs to construct short term back spreads that is likely to fetch positive cash flows as per the indications by sensitivity table.

So, keeping all these attributes in mind, here goes the strategy, go long in 1M 2 lots of ATM -0.49 delta put, and in 2M (0.5%) OTM -0.36 delta puts, while shorting 1 lot of ATM put and (0.5%) OTM put with both expiries of 1 week.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025