Anyone, if at all, is holding AUDUSD call spreads with the optimism that USD would come under modest pressure in the wake of the dovish FOMC, and that AUD was well placed to capitalize on this given the already inverted slope of the Australian yield curve, it is wise to insulate AUD rates from the inevitable re-think of global monetary policy.

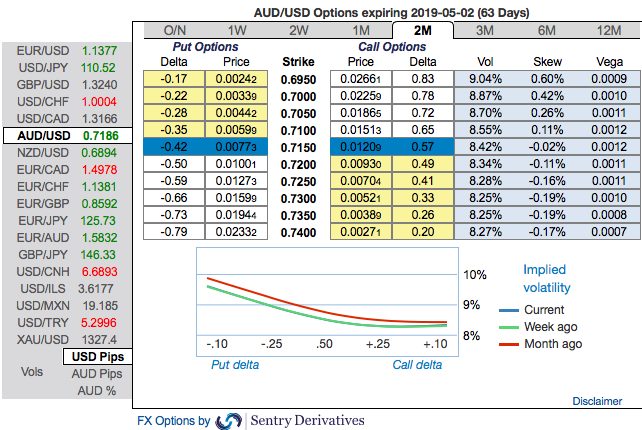

Most importantly, let’s just quickly glance through AUD’s OTC markets. The bearish risk reversals coupled with IV skews of this pair across all tenors indicate downside risks remain intact. While the implied volatilities (IV) are also shrinking below 9% for 1m – 6m tenors which is not conducive for call options holders. As a result, good to unwind the call options positions.

Benefiting from the shift in the monetary policy sentiments seemed unjustifiable, as especially the RBA, which unexpectedly dropped its implicit tightening bias and thereby allowed the domestic market to more fully price a rate cut over the coming year.

Chances are that the market will bring forward its pricing for an ease unless the domestic data improves quickly, and so whereas last week we believed there was value holding this trade as a low-delta option on resolution to US-China trade conflict, this week we take losses and exit the trade as it seems that the domestic policy risks to AUD are liable to intensify.

The danger now for AUD is that it starts to decouple from other high-beta assets, and if so there is likely to be value in using AUD to fund exposure in other high-beta currencies to benefit from either an early stage pick-up in global growth or a de-escalation of trade conflict. Potential de-correlation trades include selling AUDUSD calls to fund selective long EM exposure, or owning hybrid options such as dual digitals with AUD lower/US equities higher.

On hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.70 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -63 levels (which is bearish), while hourly USD spot index was at -63 (bearish), while articulating (at 12:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One