The euro has scope to trade into a lower range below 1.12 if the European Central Bank (ECB) strikes a dovish tone at its governing council meeting on April 10. The ECB may, after its surprise TLTRO III announcement on March 7, follow through with a tiered deposit rate to help banks cope with the weak Eurozone economy. As the largest component in the DXY Index, the weak euro has been a key reason why the US dollar has held up well against the Fed’s extended pause and US President Trump’s push for easing. The Fed will reaffirm, in its FOMC minutes on April 10, that the risks to the US economy come not from its rate hikes but from increased global risks.

Keen to avoid a negative impact from a disorderly Brexit, the EU has been supportive of a lengthy extension for a Brexit rethink. Prime Minister Theresa May has, however, asked for another short delay to June 30, making a last-ditch wager to get the opposition Labour Party to support her withdrawal agreement. It remains to be seen if “Remainder” Labour leader Jeremy Corbyn can get his party behind the idea, not to mention the risk of a backlash from Mrs May Conservative Party. We cannot totally discount the EU-27 nations, at its summit on April 10, that UK lawmakers are too divided to avert Britain stumbling out of the EU without a plan on the delayed April 12 deadline. Hence, speculators may be comfortable with paring their gross short sterling positions to their lowest levels since October 2014, well before the Brexit referendum in June 2016. Rebuilding these shorts could bring the pound below 1.30 levels.

EUR OTC Updates:

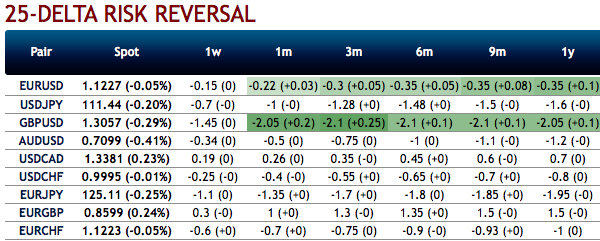

Hedge EUR-denominated income via risk reversals (RRs): The bearish neutral RRs of all euro crosses (except EURGBP) across all tenors have still been signaling downside risks.

We cannot afford to isolate hedging sentiment with this tool alone, this is evident while observing the 3m positively skewed IVs of EURJPY & EURUSD that are in line with the above-stated bearish scenarios. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

We see potential further USD strength and limited risk of significant USD weakening in the short-run, and notably, our EURUSD forecast is now running close to forwards on all horizons (vs previously above) and across tenors. Courtesy: Sentrix, Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 111 levels (which is highly bullish), USD is at -48 (bearish), while articulating (at 07:18 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?