The steeper EUR vol curve on ECB’s soft taper As has become par for the course in recent years, the December ECB meeting surprised by delivering a soft taper that reduced the pace of asset purchases, but forestalled a vicious bond market rout by offering a maturity extension sweetener and keeping open the possibility of increasing program size/duration as required.

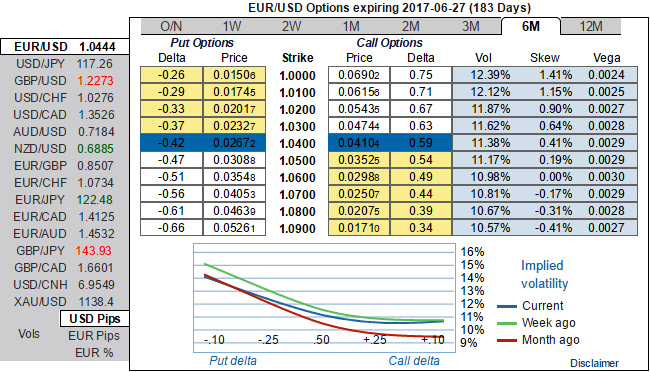

Both Short and longer term volatilities are likely to benefit the USD - Diverging monetary policy indicate a stronger USD. While risk reversals of 6m tenors also indicate the high degree of bearish risks. 6m IV skews are the evidence of the hedgers’ interests of OTM put bids.

Longer-dated implied vols, especially expiries spanning the Dutch and French elections should, however, prove to be a more reliable, persistent store of event risk premium and relatively immune to tactical gamma developments.

As a result, in the diagram, please note and compare yield curves (2:1 PRBS) on shorts (of 1m expiry and 6m expiry) in put ratio back spreads, when you deploy shorter tenor in option writing, the chances of obligation would be lesser as you could see the similar strike on 1m expiry carries attractive positive cashflows than on 6m expiry because of less chance of exercising options.

List of major significant events in H1’2017 that could pose potential risks to EURUSD and 6m OTC indications to address these events:

As was widely expected, the FOMC raised the target range for the federal funds rate by 25bp to 50-75bp at its December meeting.

On the flip side, the FOMC is likely to raise its target range for Fed Funds interest rates by 25bp to 0.50%-0.75%, almost exactly one year after the first rate step that brought an end to zero pct interest rates.

Although the road to the first round of the French Presidential election (23 April) is still long, we believe Mr Fillon’s election as the Republicans’ candidate should provide the markets with some reassurance. Under our baseline scenario, we see a referendum on EU/euro membership as unlikely. Such a referendum remains highly dependent on the results of the general election.

Italy remained in the spotlight this week with a new government, mixed news about banking sector restructuring and risks of a referendum on past labor market reform.

Elsewhere, the upcoming German federal polls would elect the members of the Bundestag, the federal parliament of Germany in 2017.

The expectation of EURUSD to reach parity between now and the French elections in April/May. For the Euro, this hawkish surprise comes a few months ahead of our expected timeline, and should partially offset the dollar drama unfolding since last month’s US Presidential elections as well as any low-intensity European electoral stress next year to restrict EURUSD to a fairly tight 1.04 – 1.08 range over coming months.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data