The medium-term view on the euro remains bullish in anticipation of a pivot in ECB policy. EURJPY year-end forecast is between 129.50 and 130.50 and likely to persist to be in the little-extended range during Q1 majorly owing to two significant factors.

Firstly, Italian and Japanese elections’ risks to dominate.

Secondly, in the October meeting, we now expect the ECB to announce a slower but longer taper, specifically a 9month QE extension at €20bn per month versus our earlier expectation of a 6-month extension.

Recent political developments in the Euro area have garnered attention. In Spain, the acrimonious standoff between the central and Catalan government has intensified uncertainty following the illegal referendum in which 90% of the voters voted for independence, resulted in a 20bp widening in Spain-Germany yield spreads intra-month.

Historical experience from valuation frameworks suggests that euro valuations are not yet a constraint for further strengthening. On long-term valuation metrics, even though the euro has strengthened by 15% in TWI terms since the post-QE bottom, historical experience from other major currencies where markets perceived an impending end of QE programs showed a larger, 26% strengthening in TWI on average.

Chart 3 shows that dollar rallied by as much as 27% from its post-QE bottom, GBP rallied by 22% as markets priced in a less accommodative policy from the BoE (till the prospect of Brexit halted/ reversed that march higher) and JPY strengthened by 30% post QE2 as markets doubted the inability of the BoJ to deliver any additional QE (yield curve control was not being discussed at that time).

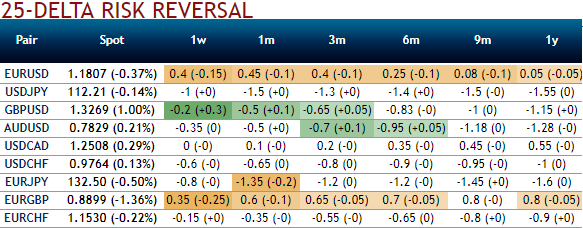

Please be noted that the risk reversals are still indicating bearish risks, while positively skewed IVs of the same tenor signifies the hedgers’ interests in OTM put strikes. On the flip side, if you look at the technical chart of this pair, the major trend has been rising higher. The technical indicators have also been substantiating the strength and momentum in this consolidation phase.

Hence, we advocate diagonal credit call spreads on hedging grounds to participate both short-term downswings and long-term upswings.

This option strategy to keep the potential bullish price risk caused out of fundamental events on the check.

Keeping the both fundamental and technical factors in mind, it is advisable to initiate long in 3M (1%) OTM 0.36 delta call while writing 1m (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields