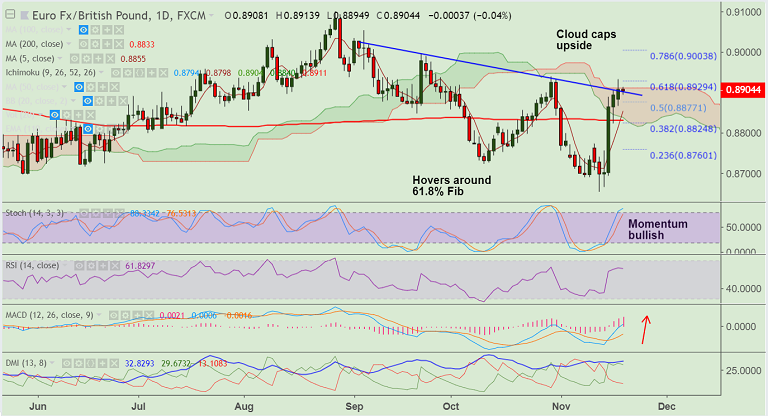

EUR/GBP chart on Trading View used for analysis

FxWirePro Currency Strength Index for EUR/GBP: Bias Bullish

FxWirePro's Hourly EUR Spot Index was at 90.561 (Bullish)

FxWirePro's Hourly GBP Spot Index was at -95.3393 (Bearish)

Technical Analysis: Bias Bullish

- EUR/GBP has shown a break above strong trendline resistance at 0.89

- The pair struggles at daily cloud, break above to see further upside

- RSI is above 50 and MACD is showing a bullish crossover on signal line.

- We evidence a bullish divergence on RSI and Stochs which raises scope for further gains.

Support levels - 0.8877 (50% Fib), 0.8856 (5-DMA), 0.8833 (200-DMA)

Resistance levels - 0.8929 (61.8% Fib), 0.8939 (Oct 30 high), 0.90 (78.6% Fib)

Recommendation: Stay long on break above daily cloud, SL: 0.8870, TP: 0.8930/ 0.90

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: EUR/GBP Trade Idea

Tuesday, November 20, 2018 6:42 AM UTC

Editor's Picks

- Market Data

Most Popular

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics