The recent developments in the Swiss franc have been less intense over the past month than in the latter part of July when the surge in EURCHF fuelled an expectation in certain quarters that the franc was on the cusp of a material downgrade against a resurgent euro.

SNB is scheduled for its Libor rate announcement today which would be out shortly and streets’ consensuses are that SNB to maintain status quo.

You can foresee bearish scenarios of CHF given the fact that SNB resumes FX intervention at higher spot rates than previously and can be bullish if SNB desists from intervention over a multi-month period. Potential trigger events are SNB intervention (weekly sight depos, monthly stats, P&L on Swiss reserves)

The key interrogation over franc valuation: Notwithstanding the SNB's repeated assertions that the franc is “significantly overvalued", there is the little economic impact from said overvaluation. The Swiss current account, for example, is the largest among the G10 economies, and it has averaged over 10% of GDP in the past few years despite the franc's sharp appreciation. Even on the question of the franc’s valuation, one could derive vastly different conclusions using either the PPP or FEER methodologies (refer above chart).

Gradual reflation: The climbing Swiss PMI indicator and the cyclical upswing in the euro area suggest that Swiss growth should be well supported in the coming quarters, despite the recent weakness in the GDP data. CPI inflation readings have also been trending fitfully higher into positive territory since late 2015, albeit still languishing under 1%. Switzerland, therefore, appears to fit well within the broader European reflation story.

Broad euro strength lifting EURCHF: The SNB fought hard to staunch franc appreciation in the past few years, and EURCHF has finally started to climb as the ECB inched toward policy normalization. The Swiss franc remains a favorite safe haven currency, but barring global volatility spikes, we expect EURCHF to be dragged gradually higher by the appreciating euro. (Refer above graph).

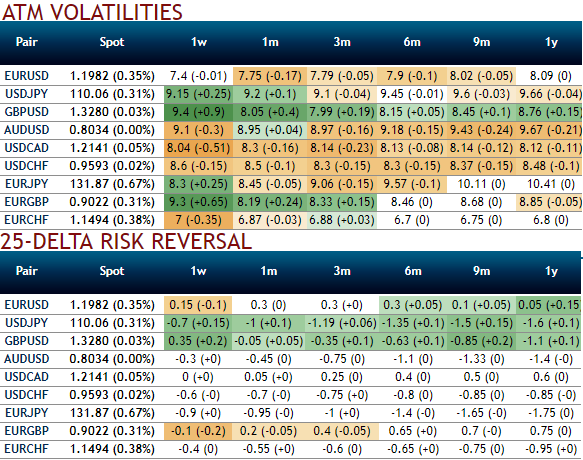

SNB needs to lag the ECB: The ambiguity regarding the franc’s valuation means that the SNB cannot rely on a valuation mean-reversion process. It remains the key that the SNB continues to lag the ECB in policy normalization. Weaker inflation in Switzerland certainly argues for greater prudence on the part of the SNB. The CHF vols and correlations have soared following the recent spike in EURCHF, but IVs have still been tepid (least among the FX pool) and JP Morgan reckons that the flipside of this, lack of participation is the availability of RV opportunities in the CHFCHF-cross option space.

Currency Strength Index: Ahead of Swiss central bank’s monetary policy, FxWirePro's hourly CHF spot index was at shy above -97 (highly bearish) at 06:47 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

http://www.fxwirepro.com/invest

Courtesy: JP Morgan, SG

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios