USDJPY has been turbulent (109.132 is keenly watched) and would be volatile this week as two monetary policies are scheduled in the near future, Federal Reserve for this week, and BoJ for the next week.

With the FOMC meeting this week, there would be questions about whether the labour market strength will compel the Fed to be less generous with its monetary largesse now. We doubt it. Having come so close to a market paralysis in March, it is not going to risk nipping any nascent recovery in the US labour by hinting at any shade of hawkishness now.

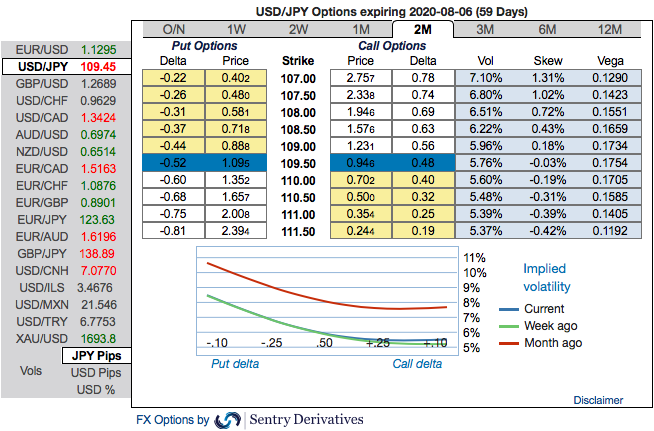

While our perspectives on Japanese yen against the dollar remains above 100 levels. If not for liquidity constrains a contained yen upside could be efficiently expressed via defensive USDJPY OTM put calendars that utilize the once in a generation skew-vol setup.

We opt for fading the curve inversion via vanillas on the weak side of the riskies to avoid left tail exposure.

At spot reference: 107.120 levels, we advocate buying a 2M/2w 108.910/102 put spread (vols 8.95 vs 8.55 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

The rationale: The positively skewed IVs of 2m tenors of USDJPY contracts are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 107.50 levels, whereas 2w skews signal both bullish and bearish risks (refer 1st & 2nd nutshells).

To substantiate this directional stance, one can trace out fresh bids of positive numbers for the existing bearish risk reversal numbers, this also signals current hedging interests for the downside risks amid mild upswings (3rd nutshell).

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we upheld the same positions, as the underlying spot FX likely to target southwards in the medium run. Courtesy: Sentry & Saxo

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate