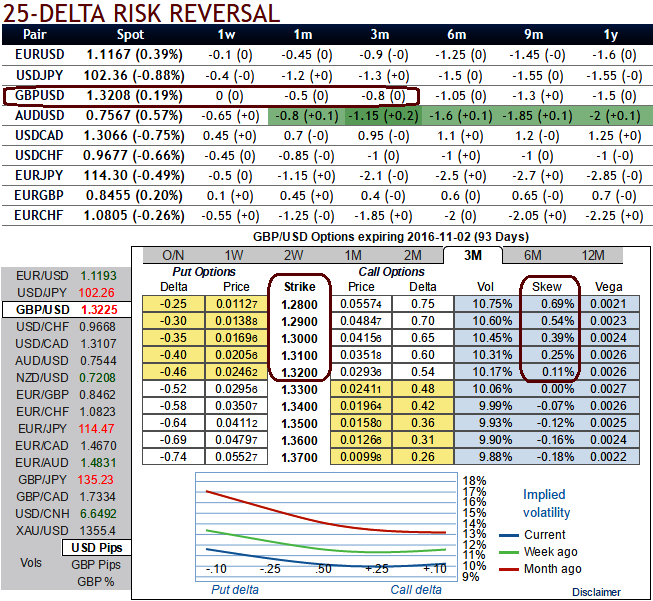

Needless to specify, GBP vols have still been flying with sky rocketed pace no matter what both prior and post-Brexit events, but this time these IVs are also owing to BOE’s monetary policy decision, however, the contracts with longer tenors are normalized too, just a tad above 10%.

Post Brexit adjustments saw leveraged funds reduce their net long USD positions for the week ending 28 June. This was despite the DXY rallying following the Brexit result. The USD selling was broad based against all the major currencies.

Buy GBP/USD 3m risk reversal strikes 1.28/1.3575

Indicative offer: zero cost (spot ref: 1.3230), on a technical perspective, 1.35 should remain a strong horizontal resistance as the 2009 low and the level rejected when the cable tried to bounce in mid-July.

We look ahead for the pair to remain capped below this level. The high strike is set at 1.3575 and the put strike at 1.28 such that the package is zero cost or atleast reduce cost.

The position is naturally long vega on the downside and short on the topside, fitting with the volatility market dynamics. Cable skew normalised too much Five weeks after the Brexit vote, the GBP volatility market normalised sharply.

Risks are foreseen as unlimited above 1.3575, the investors face unlimited risk if the cable moves above 1.3575 at the 3m expiry. They would have to hedge the trade’s delta in such a scenario.

BOE has now enough reasons to ease monetary policy as there is no point in pretending otherwise: the Brexit vote will be a hard blow for the UK economy. As well as the economy developed in Q2, the collapse in Q3 will be very painful. The PMI has provided a first taster. It eased significantly from 52.4 points in June to 49.1 points in July, the final estimate now resulted in a real collapse to 48.2 points.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty