As we see more upside potential on this metal as the bulls showing more buying interest in approaching last month’s peaks of 17.993 levels, while both leading as well as lagging indicators are in favour of intermediate bulls. RSI and stochastic are conformity to the intensified momentum in on-going rallies, while DMAs and MACD indicate the trend uptrend continuation. Hence, we could foresee more upward journey, probably up to 17.993 sooner.

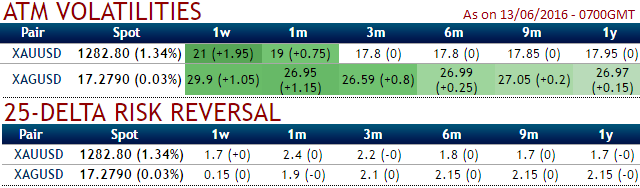

While we were strategizing the hedging frameworks, we came across the implied volatility of 1W ATM contracts are spiking higher above 29% (a tad below 30%) but reducing a bit during 1m tenor, so the rationale is that any abrupt dips should be optimally utilized to maximum extent, so to participate in that downtrend, weights in the portfolio should be increased with more number of call options.

Implied volatility is an important factor to consider in options trading because the prices of options are directly affected by it. A security with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive.

We urge that this is just an intuitive due to the higher likelihood of the market 'swinging' in your favour if IV increases and you are holding an option, this is good.

The option price as an input is the premium pair or credit received, this is expressed by what is referred to as the bid/ask spread (the bid prices are derived from the buyers and the ask prices are derived from the sellers).

Hence, the delta neutral options strategies that are designed to create positions that aren’t likely to be affected by small movements in the price of the underlying price of the spot Silver.

This is achieved by ensuring that the overall delta value of a position is as close to zero as possible.

Delta value is one of the Greeks that affect how the price of an option changes.

Strategies for this metal that involve creating a delta neutral position are typically used for one of three main purposes, namely:

Profiting from Time Decay, Profiting from Volatility and Delta Neutral Values in hedging.

On the Comex, Silver futures for July delivery slipped from day highs of 17.408 to trade currently at $17.33 a troy ounce during morning European trading session. Therefore, by writing options to create a delta neutral position, you can benefit from the effects of time decay and not lose any money from small price movements in the underlying security as the IVs to fade in the short run but not significantly.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data