The AUDUSD momentum remains positive for today but slightly weaker. We look for another push above 0.7500, which will probably happen if there’s a bout of long-USD profit-taking post FOMC tonight.

AUD/USD 1-3 month: The US dollar has had an impressive rise since the US election and has potential to rise further during the months ahead, not least because the Fed will probably hike in December. Against that, coal and iron ore are more likely to sustain their dramatic rises during the months ahead. We target 0.73.

In Australia, the Westpac MI consumer sentiment survey should be affected by the US election; the share market surge and a negative print for Australian GDP.

US retail sales data will provide a minor distraction ahead of the FOMC decision. We expect growth slowed in Nov.

The day’s highlight will be the FOMC meeting, where a Fed funds rate hike to a 0.50%-0.75% range is widely expected (and priced in by markets). Thus, any surprises will come from the tone of the statement and Yellen’s press conference. Also of interest will be the updated economic forecasts and Fed funds rate projection, with markets currently fully agreeing with the two hikes projected in 2018.

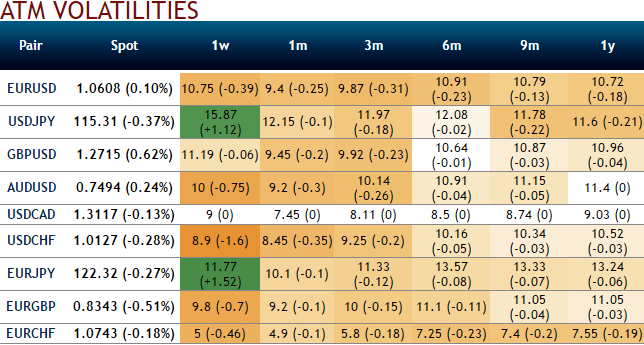

OTC updates and hedging Framework:

Please be noted that the implied volatility of at the money contracts of this APAC pair has been dropped to 10% for 1w expiry and below 9.5% for 1m tenors but still well above 10% for 3m tenors and 3m IV skews are signifying the hedgers’ interests in downside risks.

Additionally, the delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair has been oscillating between 0.7761 and 0.7305 with forecasts below 0.73 levels in Q1’2017. The short-term trend indicates slight upside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run and bid on 3m risks reversals.

The OTC options market appeared to be more balanced on the direction for the pair over the 3m to 1y time horizon and as a result delta risk reversal for AUDUSD has been maintaining negative which means puts are in higher demand and overpriced comparatively.

Hence, AUDUSD's lower IVs with positive delta risk reversals could be interpreted as the option writer’s opportunity in short run.

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

“Short 1m (1.5%) ITM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 3m ATM +0.49 delta put options and 1 lot of (1.5%) OTM -0.37 delta put of 3m expiry.”

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty