FED’s dot plot, which represents policymakers’ expectation of future rates going forwards is working its magic but not in favor of Dollar, this time around. Reason is simple, all of Federal Open Market committee (FOMC) participants largely scaled back their expectations of future hikes.

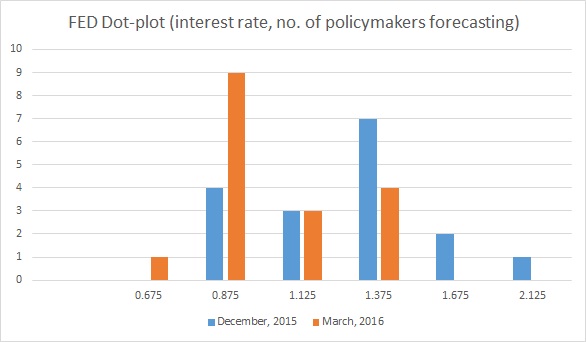

We presented the change from December in the graph,

- Which clearly shows even the most hawkish of all, who expected FED rate to reach 2-2.25 range scaled back expectations by more than 50 basis points and possibly in tune of 75 basis points. No policymakers forecasted rate more than 1.25-1.5 range.

- Participants are more convergent in their views over future hikes. Back in December, the gap between low to high range 130 basis points and that in March meeting got reduced to just 70 basis points.

- About 7 participants among 17 were expecting a rate increase 100 basis points in 2016 back in December, compared to that more than 50%, 9 of the participants now see rate hike of 50 basis points.

FED’s projection material shows FOMC rate forecast has dropped by 50 basis points to 0.9% for 2016.

With 50 basis points reduction in expectations Market and FOMC are more aligned now.

Dollar has taken a big hit over the change and after last night’s big drop, still struggling today. Dollar index is currently trading at 95.11, down -0.65% for the day.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.