New Zealand's economy expanded more than expected in the fourth quarter of 2015, but the tepid inflation picture suggests more rate cuts from the central bank. New Zealand's GDP rose a seasonally adjusted 0.9 percent in Q4 versus the prior quarter and 2.3 percent on the year, data showed last Thursday. Data beat consensus for the economy to expand 0.6 percent on quarter and 2.0 percent on year.

However, weak Chinese economic outlook and the increased volatility on the financial markets is creating considerable headwinds for growth. Continued low milk prices are putting massive pressure on the terms of trade and as a result also on New Zealand’s global competitiveness. That said, outside of the dairy sector sentiment is considerably better. Low interest rates, high immigration levels, tourism and the continued strong activity of the building sector are driving domestic demand at present.

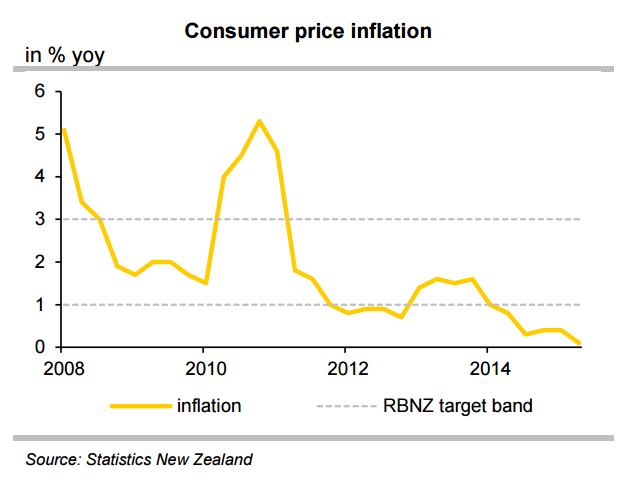

RBNZ surprised markets earlier this month with a decision to cut its official cash rate by 25 basis points to 2.25 percent, citing a material decline in a range of inflation expectation measures. The central bank's decision came despite the fact that the environment was generally more benign compared with the January meeting.

The main reason for the renewed rate cut is likely to have been the strong NZD, which is trading well above the levels the RBNZ considers justified in view of weak export prices. The central bank also signalled at least one more rate cut to come, should the return to the inflation target be dented by an excessively strong NZD.

In the final quarter of 2015 inflation disappointed notably. At 0.1% yoy it is well below the RBNZ’s target area of 1-3%. The continued or increasing downward risks for inflation caused by falling commodity prices and a recently stronger NZD are putting pressure on the RBNZ. In March trade weighted NZD traded more than 4% above the level the RBNZ had assumed in its Dec forecast indicating a risk to the inflation outlook. NZD/USD was trading at 0.6700 at 1100 GMT.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady