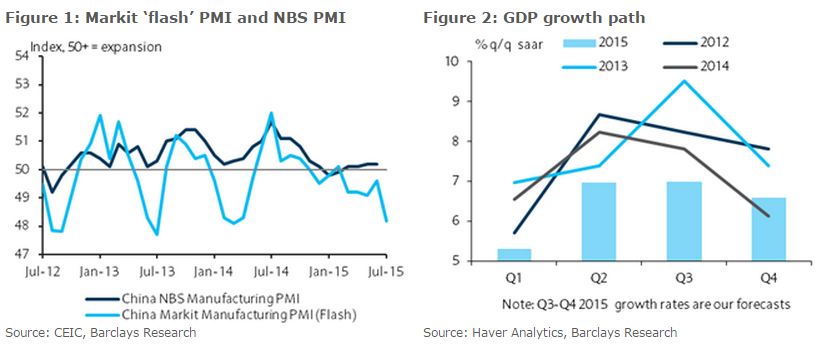

The Markit “flash” manufacturing PMI unexpectedly fell to 48.2 in July, reaching a 15-month low. The headline PMI deteriorated from its final reading of 49.4 in June, with the output sub-index worsening to 47.3, a 16-month low. The new orders sub-index fell to 48.1 from 50.3 in June, accompanied by soft new export orders. The decline in the output prices and input prices sub-indexes accelerated, a trend that is likely to continue to exacerbate PPI deflation and weigh on manufacturing activity. The employment conditions component remained soft, reflecting corporates’ muted expectations for demand conditions both at home and abroad, although it declined at a slower rate in July.

The weaker PMI supports our view that the economy is not on solid footing, and we look for a flat growth profile in H2. Electricity consumption, auto sales and company-level evidence suggest growth has remained soft. The leverage-driven equity boom-bust has hurt sentiment and poses downside risks to growth. Falling commodity prices are also likely to discourage restocking and investment. With the government appearing comfortable about the labour market situation in Q2, we expect flat sequential growth momentum of 7.0% q/q saar in Q3 and 6.6% in Q4, from 7% in Q2.

"We expect the overall fiscal and monetary policy mix to stay accommodative, although the pace of broad-based monetary easing is likely to slow. We expect fiscal policy to be more expansionary, with increasing local government spending to support investment, particularly in infrastructure. The possible announcement of a third CNY1trn local government debt swap plan, with close to CNY1trn completed so far, should help to support local government spending. We believe the continued downside risks to growth and the expected large pipeline of local government debt issuance justify further monetary easing. Therefore, in addition to the recent interest rate cut and targeted RRR reduction, we continue to look for one benchmark rate cut of 25bp in Q3 and one to two RRR cuts of 50bp each in H2 15, depending on liquidity conditions. Meanwhile, the state council this week made an explicit comment that “China will expand the CNY two-way trading range”. We note that on 15 March 2014, the PBoC widened the USDCNY trading band to ±2% from ±1%, after similar statement about the two-way trading range was made in a government work report issued on 5 March 2014," Barclays Research noted in its research report.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One