China is developing a new rare earth export licensing system that could accelerate shipments but is unlikely to represent a full rollback of restrictions, according to industry insiders. The Ministry of Commerce has informed select exporters that they will soon be able to apply for streamlined permits, signaling a partial easing of the export curbs that have strained global supply chains.

China currently dominates more than 90% of the world’s processed rare earths and magnet production—essential materials for electric vehicles, smartphones, and military technology. The export restrictions, introduced in April and expanded in October, required exporters to apply for licenses for each shipment, creating delays that disrupted industries worldwide. The curbs also gave Beijing a powerful trade leverage tool amid its ongoing tensions with Washington.

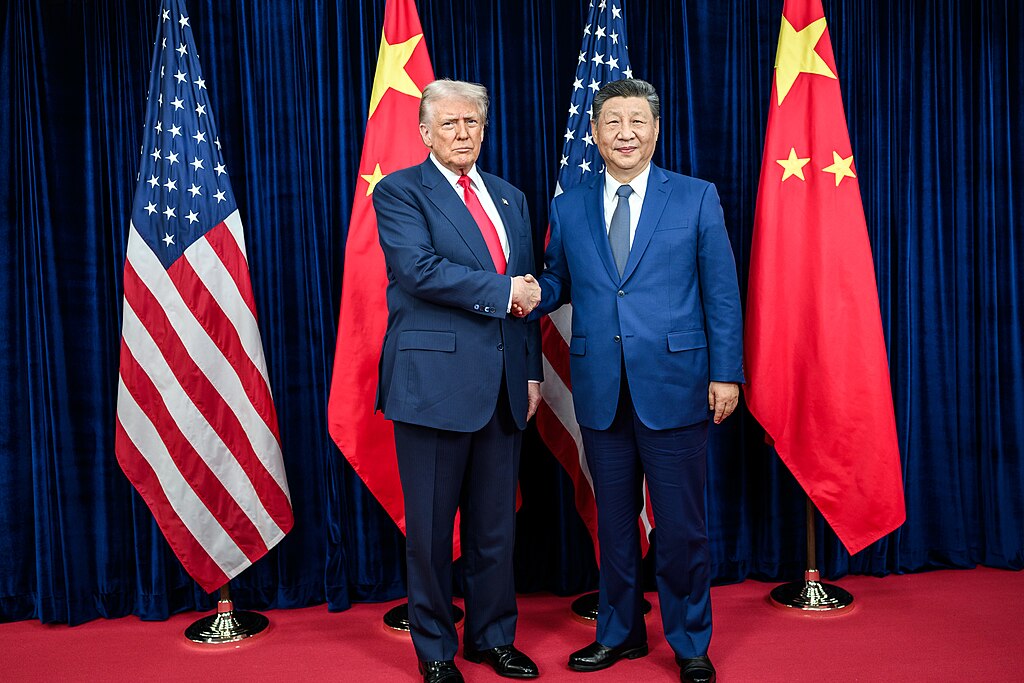

After a recent agreement between Presidents Xi Jinping and Donald Trump, Beijing announced it would pause some restrictions for one year. The White House interpreted this as an effective end to China’s export controls, citing plans for “general licenses.” However, sources close to the matter say the new permits will still maintain oversight and limitations, especially for companies linked to defense and sensitive technologies.

The proposed general licenses would be valid for one year and could allow higher export volumes. Exporters are now preparing documentation that demands more detailed information from customers. While some companies expect further clarity before year-end, others report no official notice of the change.

Despite the potential easing, the new system is not expected to remove all export barriers. Of the 2,000 rare earth export applications submitted by EU firms since April, only about half have been approved. As discussions continue, the global market remains cautious, awaiting how China’s new rare earth policy will reshape supply chains and trade relations.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges