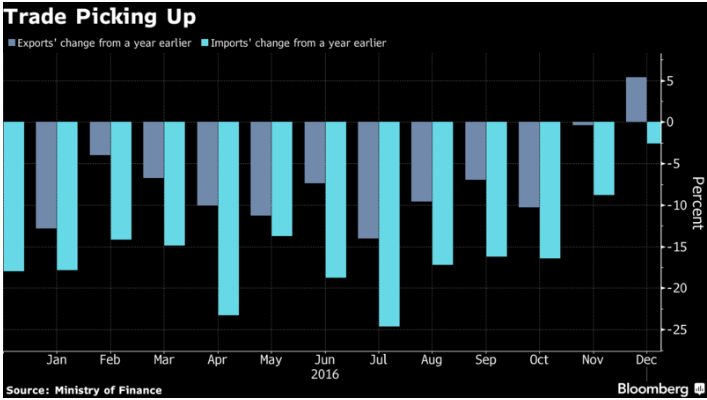

Japan on Wednesday reported its first annual trade surplus since 2011 Fukushima nuclear disaster. Data released by the Ministry of Finance on Wednesday showed that Japan posted a 4.07 trillion yen ($35.8 billion) annual trade surplus last year, the first since 2010. The data on Wednesday also showed that Japanese exports snapped run of declines and rose for the first time in 15 months in December.

The trade data should be welcome news for the Bank of Japan, which is seen maintaining an upbeat view on the economy. BoJ Governor Haruhiko Kuroda at the World Economic Forum at Davos was optimistic that Japan's economy is likely to head toward a sustainable growth path as global trade and manufacturing activity pick up.

Bank of Japan’s (BoJ) first 2-day monetary policy meeting for 2017 is scheduled to be held on January 31. We foresee that the central bank will remain committed to hold its 10-year JGB yields near zero, while keeping interest rate steady at -0.10 percent.

Markets will be closely watching the release of December consumer price inflation data, scheduled for Friday. Inflation and consumer spending have been weak, and firms have been reluctant to boost wages, dragging on Abe’s plans to buoy Japan’s once-booming economy.

The yen makes solid comeback, regained bullish momentum on upbeat Japanese trade data. USD/JPY was trading at 113.48 at the time of writing, down 0.25 percent on the day. Technical indicators on weekly charts support downside. Stochs are rolling over from overbought and MACD is on verge of a bearish crossover. We see scope for test of weekly 200-MA at 109.53. Bearish invalidation above weekly 5-MA at 115.20.

Japan’s Nikkei 225 closed 1.45 percent higher at 19,061. FxWirePro's Hourly Currency Strength Index at 1200 GMT showed yen hourly strength remained neutral at -3.83747 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend).

For more details, visit http://www.fxwirepro.com/currencyindex.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran