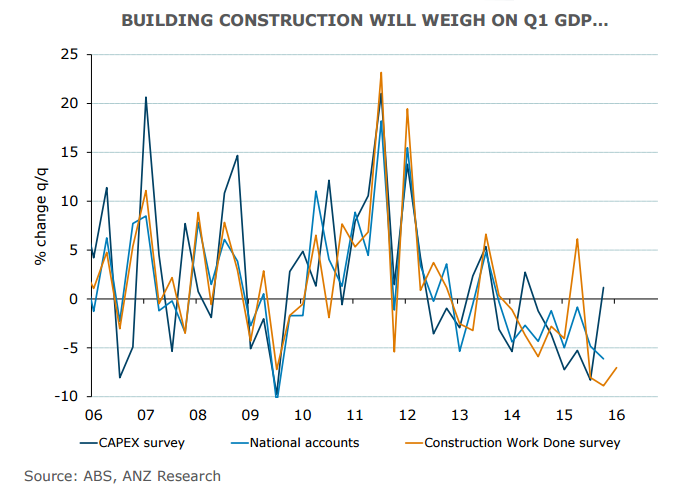

Australia’s total construction work fell again in the first quarter of 2016 due to further weakness in engineering construction and sharp decline in non-residential building. Total construction in Q1 declined 2.6%, as compared with consensus expectations of a decline of 1.5%. This is the ninth decline in the last 10 quarters. On an annual basis, construction is down 7%.

Housing construction activity remains strong, with gains in both the construction of new homes and renovations to existing homes. However, private non-residential building work which posted the heaviest fall since 2009, down by 8% in Q1, was the main drag. Public construction up 2.5% in Q1, but was unable to offset the drag by private non-residential building. Engineering construction fell by 7% in Q1 and is down 21% over the past year.

ANZ economists said despite the gains in home-building, drops in private engineering and non-residential construction would weigh on economic growth. These data suggest to us that business investment will be a drag on next week's GDP outcome, they said.

Australian Bureau of Statistics notes that construction activity is the major inputs used to compile the GDP estimates for private gross fixed capital formation on dwellings, and other buildings and structures. And data released today showed the first of Australia's GDP inputs has fallen short of expectations.

ANZ forecasts that the contraction will cut 0.4 percentage points off Australian GDP in March quarter. Focus will now turn to the release of Australian Business capital expenditure for the March quarter on Thursday. Expectations are for plant, machinery and equipment expenditure, an input into GDP to contract by 2.0% having risen 0.1% in the previous quarter.

Aussie shrugged-off weak construction data to extend gains on the day. AUD/USD was at 0.7208, while AUD/NZD was at 1.0648 at 1230 GMT.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings