Wall Street remains cautious as global headlines shake up markets. The fatal shooting of UnitedHealth’s CEO, Brian Thompson, a prominent leader in the U.S. health insurance industry, is one of the most shocking events of the day. Thompson was killed in New York City Wednesday in what police believe was a premeditated attack. The tragic incident has cast a shadow over the markets, particularly as investors digest the news and anticipate possible disruptions in the healthcare sector.

Thompson, who had been at UnitedHealth since 2004 and became the CEO of its insurance division in 2021, was in New York for an investors' meeting when the attack occurred. According to police, the killing was not random, and the motive appears to be targeted. Thompson's wife, Paulette, revealed that he had received threats related to his work, although the exact nature of those threats remains unclear.

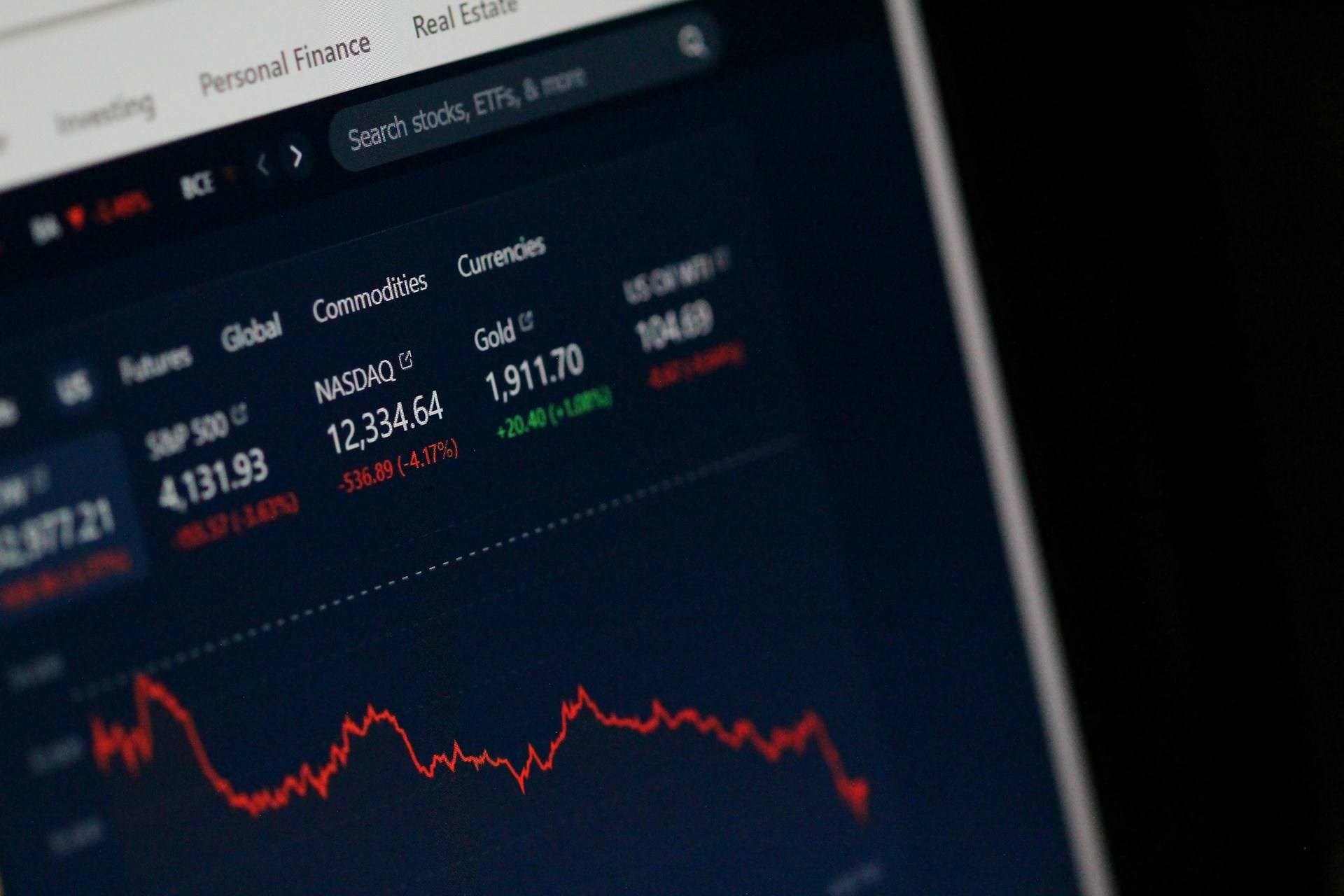

As investors grapple with the news of Thompson’s death, Wall Street futures showed little movement on Thursday. U.S. stock futures were constrained within tight ranges as traders awaited more economic data, including jobless claims and the highly anticipated jobs report on Friday. Despite the tragic news, the broader markets have managed to remain resilient, driven by optimism regarding the strength of the U.S. economy and corporate earnings. Stocks had closed at new record highs the previous day, following Federal Reserve Chair Jerome Powell's comments on the economy's strength.

In other global developments, Bitcoin surged past the $100,000 mark, reaching a new high as traders reacted to President-elect Donald Trump’s recent nomination of Paul Atkins as the new head of the U.S. Securities and Exchange Commission. Atkins, who has shown support for cryptocurrencies, is expected to replace the current SEC Chair, Gary Gensler, in January. The move is seen as a positive signal for the cryptocurrency market, which has struggled with regulatory uncertainty in recent years.

Meanwhile, the oil market is seeing subtle shifts. Prices for U.S. crude oil ticked upward following reports of a significant draw in U.S. inventories. Oil traders are also keeping an eye on an upcoming OPEC+ meeting, where the group is expected to discuss extending production cuts to maintain price stability. Shell and Equinor also announced a joint venture to form the largest independent producer in the U.K. North Sea by 2025, adding further intrigue to energy market dynamics.

However, the most unsettling news comes from France, where Prime Minister Michel Barnier is expected to resign following a vote of no-confidence. The resignation comes after a bitter clash over a controversial budget aimed at addressing a growing deficit. The political fallout from Barnier’s departure is expected to create uncertainty in French markets and could destabilize the broader European Union. The timing is especially critical as the EU faces multiple challenges, including political turmoil in Germany and financial instability in several member states.

Philippine Economy Slows in Late 2025, Raising Expectations of Further Rate Cuts

Philippine Economy Slows in Late 2025, Raising Expectations of Further Rate Cuts  Gold Prices Hit Record High Above $5,500 as Iran Strike Fears Fuel Safe-Haven Demand

Gold Prices Hit Record High Above $5,500 as Iran Strike Fears Fuel Safe-Haven Demand  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Gold Prices Pull Back After Record Highs as January Rally Remains Strong

Gold Prices Pull Back After Record Highs as January Rally Remains Strong  Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions

Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions  U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal

U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal  Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support

Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support  Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair

Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair  South Korea Industry Minister Heads to Washington Amid U.S. Tariff Hike Concerns

South Korea Industry Minister Heads to Washington Amid U.S. Tariff Hike Concerns  Asian Currencies Trade Flat as Dollar Retreats After Fed Decision

Asian Currencies Trade Flat as Dollar Retreats After Fed Decision  Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout

Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout  UK Vehicle Production Falls Sharply in 2025 Amid Cyberattack, Tariffs, and Industry Restructuring

UK Vehicle Production Falls Sharply in 2025 Amid Cyberattack, Tariffs, and Industry Restructuring  Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions  Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify

Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify  Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets

Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. and El Salvador Sign Landmark Critical Minerals Agreement to Boost Investment and Trade

U.S. and El Salvador Sign Landmark Critical Minerals Agreement to Boost Investment and Trade